Help Us Bypass Censorship. Share This.

Sign up to receive Our Weekly Briefing Newsletter

Begin your journey with weekly insights designed to expand awareness and ground you in truth. Our free tier gives you a powerful introduction without any commitment.

The Interconnectedness of Global Economies: Risks and Opportunities

The interconnectedness of global economies presents both opportunities and significant risks. As nations engage in trade and investment, economic downturns in one region can lead to ripple effects worldwide. For instance, the 2008 financial crisis triggered a global recession that impacted economies far beyond the initial epicenter in the United States.

One key risk is the dependency on global supply chains. Disruptions, such as those experienced during the COVID-19 pandemic, can lead to shortages and inflation globally. Countries reliant on imported goods, especially essential products, may face severe challenges during such disruptions.

Additionally, geopolitical tensions can further complicate economic ties. Trade wars, sanctions, and military conflicts can create uncertainty that affects global markets. For example, the ongoing tensions between the United States and China have introduced volatility in trade routes and investment strategies, impacting stakeholders involved in global commerce.

Furthermore, the rise of technology has created risks associated with cyber dependency. As economies become increasingly digitized, they become susceptible to cyberattacks, which can disrupt services and erode consumer trust. This was notably evidenced during various breaches of financial institutions and infrastructure.

In conclusion, while the interconnectedness of global economies fosters growth, it also necessitates careful navigation of potential risks. Understanding these dynamics is crucial for policymakers and businesses alike as they strategize for resilience in an ever-evolving economic landscape.

Understanding Financial Shocks

Financial shocks refer to sudden and unforeseen events that can significantly disrupt the economy. These shocks can arise from various triggers, including natural disasters, geopolitical crises, changes in market sentiment, or systemic failures within financial institutions.

Common triggers of financial shocks include:

- Economic Crises: Events like the 2008 financial crisis, resulting from subprime mortgage failures, illustrate how swiftly financial systems can unravel. The crisis was a product of excessive risk-taking by financial institutions and inadequate regulation.

- Geopolitical Events: Political instability or conflict can also lead to sudden market declines. For example, the 1973 oil crisis triggered by the OPEC oil embargo saw global economies falter due to skyrocketing oil prices.

- Natural Disasters: Major natural events, such as earthquakes or hurricanes, have historically disrupted economic stability. The devastation caused by Hurricane Katrina in 2005, for instance, impacted not just the local economy but also created national ripples.

- Market Sentiment: Sudden shifts in investor sentiment can create financial shocks. The dot-com bubble bursting in the early 2000s serves as a notable case where overinflated tech stock valuations collapsed, leading to widespread market loss.

- Policy Changes: Changes in government policies, such as tax reforms or shifts in monetary policy, can also prompt shocks. For instance, the rapid increase in interest rates in the late 1970s led to stagnation and recession in the early 1980s.

Understanding these shocks and their historical context helps in formulating strategies for risk mitigation in economic policies and personal financial planning.

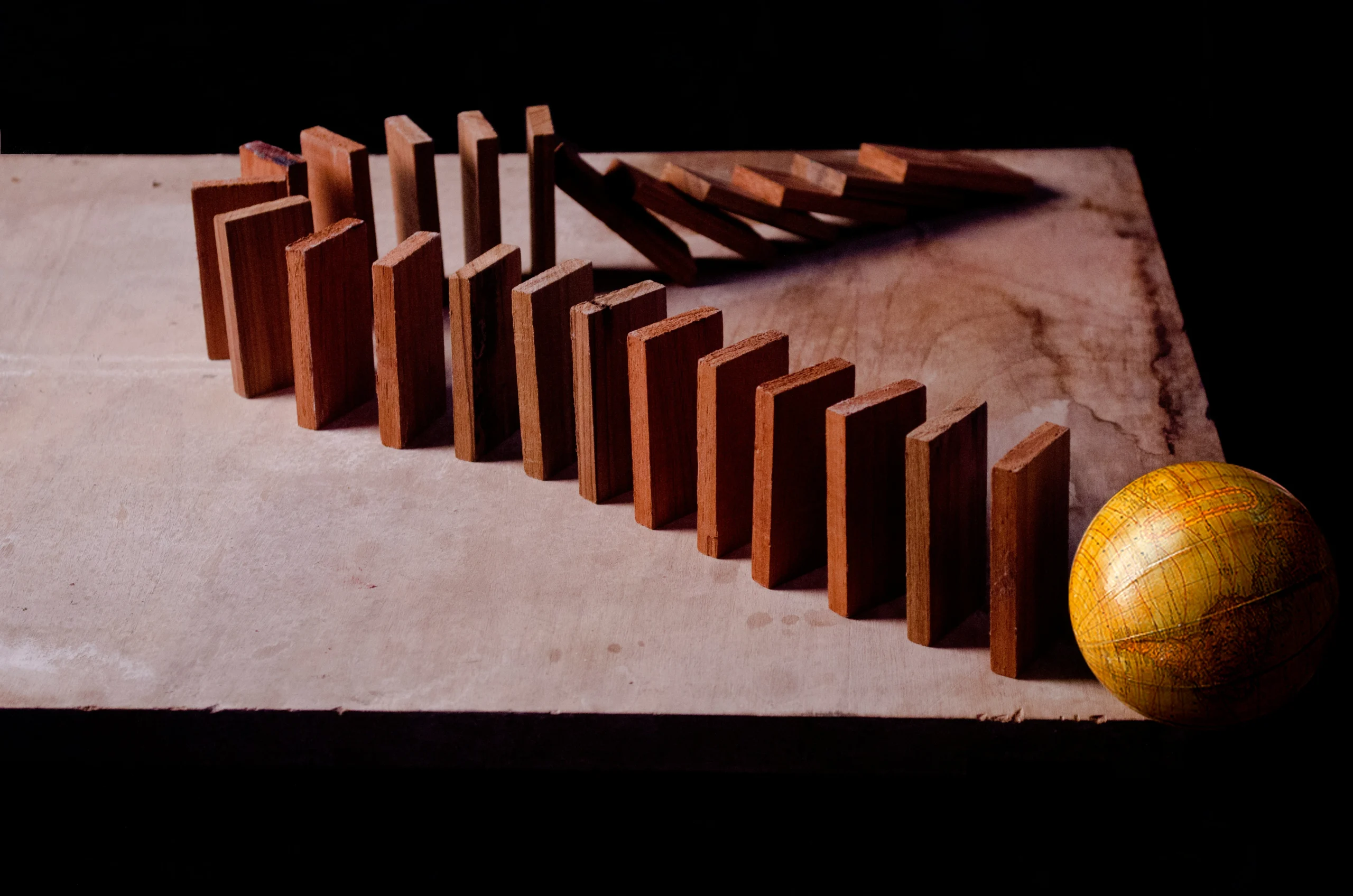

The Domino Effect of Financial Disasters

Financial disasters have the potential to trigger global economic repercussions, illustrating a domino effect that can devastate markets far from the initial crisis point. One prominent case is the 1997 Asian Financial Crisis, which originated in Thailand. The rapid devaluation of the Thai baht led to a loss of investor confidence across Southeast Asia, resulting in massive capital flight and downturns in markets even as far away as Latin America.

Another example is the 2008 global financial crisis, initiated by the collapse of the U.S. housing market due to subprime mortgage failures. This catastrophe triggered a liquidity crisis, affecting banks worldwide and leading to severe economic downturns in Europe and beyond.

The interconnectedness of global finance meant that failures in the U.S. banking sector rapidly propagated through international markets, culminating in widespread economic instability and government bailouts across several countries.

In more recent years, the COVID-19 pandemic has served as a stark reminder of how localized events can ripple through global economies. Initial lockdowns in China caused significant disruptions in supply chains, leading to a worldwide shortage of goods and skyrocketing inflation rates. Countries dependent on Chinese manufacturing faced unprecedented challenges, demonstrating the fragility of interconnected global supply networks.

These case studies emphasize the necessity for robust financial frameworks and contingency planning to handle potential cascading effects of localized financial disasters that can escalate into larger global crises.

The Role of Banks and Regulatory Bodies During Crises

The financial system’s stability is significantly affected by the actions of banks and regulatory bodies, particularly during crises. Regulatory institutions, like the Federal Reserve, play a critical role in overseeing financial institutions and implementing policies designed to mitigate risks. For example, during the 2008 financial crisis, the Fed implemented quantitative easing to inject liquidity into the economy and stabilize the financial system.

Conversely, lax regulations can exacerbate crises. Prior to the Great Recession, deregulation allowed banks to engage in high-risk lending practices without sufficient oversight, contributing to the housing bubble and subsequent economic crash.

Moreover, the interplay between regulatory frameworks and market practices can either foster stability or lead to systemic vulnerabilities, as seen in the most recent economic challenges exacerbated by the COVID-19 pandemic.

Ultimately, the effectiveness of banks and regulatory bodies directly influences the severity and duration of financial crises. Their capacity to adapt to changing economic conditions and enforce prudent practices often determines whether a situation escalates or is contained. For more detailed insights, refer to related articles on the evolving landscape of financial regulations here and the role of accountability in financial systems here.

Societal Impacts of Financial Shocks

The impacts of financial shocks on societal segments can be starkly uneven, often exacerbating existing inequalities and widening the wealth gap. Economic downturns, such as recessions, often lead to higher unemployment rates, particularly affecting low-wage workers and marginalized communities. Studies indicate that during periods of economic crisis, the wealthiest tend to recover more quickly, benefiting from existing assets, while lower-income individuals face increased difficulty in regaining financial stability.

For instance, a report by the Economic Policy Institute highlights that the wealth gap in the U.S. has significantly increased since the Great Recession of 2008, with the wealthiest households seeing a considerable recovery, while those in lower-income brackets have struggled with stagnating wages and job security.

Moreover, financial shocks can lead to cuts in social services, which disproportionately impact disadvantaged groups. According to a Brookings Institution analysis, low-income families often rely on government assistance programs during economic downturns. Reduction in these services typically results in higher poverty rates among these families.

Additionally, research by the OECD indicates that financial crises can lead to long-lasting effects on education and health for lower-income populations, compounding their difficulties over generations. These trends underline the systemic nature of economic inequality, where financial shocks not only affect immediate economic conditions but also alter the landscape of opportunity and security, reinforcing a cycle of poverty.

The widening wealth gap resultant from such shocks emphasizes the importance of policy interventions aimed at supporting vulnerable populations during financial crises to mitigate these disparities.

Strategies for Economic Resilience

To strengthen global economic resilience against financial shocks, governments and institutions can implement a multi-faceted approach:

- Enhancing Financial Regulation: Strengthening financial regulations can mitigate risks. Implementing measures such as comprehensive stress testing for banks and enhancing transparency can improve the financial sector’s resilience to shocks [Source: Bank for International Settlements].

- Diversifying Economies: Encouraging diversification in economic sectors reduces dependence on any single industry. This strategy can help countries better weather financial downturns by spreading risk across various sectors [Source: International Monetary Fund].

- Investment in Digital Infrastructure: Investing in technology and digital infrastructure can create more efficient systems that adapt to shocks more effectively. Enhancing e-commerce capabilities and digital payments can support economic continuity during crises [Source: World Bank].

- International Cooperation: Strengthening international cooperation through agreements on trade and finance can enhance collective stability. Initiatives such as timely information sharing and cross-border regulatory frameworks can help manage global economic risks [Source: OECD].

- Emergency Response Mechanisms: Establishing robust emergency response systems ensures rapid action during crises. Governments can develop frameworks for quick access to financial resources and aid for affected sectors, which can help mitigate the immediate impacts [Source: World Food Programme].

- Social Safety Nets: Strengthening social safety nets like unemployment benefits and food assistance programs can protect vulnerable populations and maintain consumer spending during economic downturns, ultimately supporting overall economic stability [Source: OECD].

Implementing these strategies in a cohesive and strategic manner can significantly enhance resilience against unpredictable financial shocks, fostering a more stable global economy.

Sources

- World Bank

- IMF

- RAND Corporation

- Great Awakening Report

- Great Awakening Report

- Great Awakening Report

- Great Awakening Report

- IMF

- Federal Reserve

- Brookings

- Bloomberg CNBC

- Federal Reserve

- GAO

- IMF

- Great Awakening Report

- King Corn Documentary

- Economic Policy Institute

- Brookings Institution

- OECD

- OECD

- Bank for International Settlements

- International Monetary Fund

- World Bank

- OECD

- World Food Programme

Help Us Bypass Censorship. Share This.

Have questions?

At Great Awakening Report, we are dedicated to supporting your journey toward truth and enlightenment through our specialized Coaching and Consulting services.

Coaching Services: Our coaching programs are designed to guide you through personal awakening and transformation. We offer personalized sessions that focus on expanding consciousness, uncovering hidden truths, and fostering spiritual growth. Our experienced coaches provide the tools and insights necessary to navigate your path with clarity and confidence.

Consulting Services: For organizations and individuals seeking deeper understanding and strategic guidance, our consulting services offer expert analysis and solutions. We delve into areas such as global transitions, alternative news insights, and consciousness studies to provide comprehensive strategies tailored to your unique objectives.

Embark on a transformative journey with our Coaching and Consulting services, and unlock your highest potential. To learn more and schedule a session, visit our Coaching and Consulting pages.

Thank you

Thank you to our subscribers and readers for your continued support and dedication to truth and awakening. Your encouragement, engagement, and belief in our mission make everything we do possible. Together, we are expanding awareness and helping illuminate the path forward.

If you would like to further support the Great Awakening team and our ongoing efforts to share insight, knowledge, and truth, you can DONATE HERE.

With deep gratitude,

– Great Awakening Team

DISCLAIMER: All statements, claims, views and opinions that appear anywhere on this site, whether stated as theories or absolute facts, are always presented by The Great Awakening Report (GAR) as unverified—and should be personally fact checked and discerned by you, the reader.Any opinions or statements herein presented are not necessarily promoted, endorsed, or agreed to by GAR, those who work with GAR, or those who read or subscribe to GAR.Any belief or conclusion gleaned from content on this site is solely the responsibility of you the reader to substantiate.Any actions taken by those who read material on this site are solely the responsibility of the acting party.You are encouraged to think for yourself and do your own research.Nothing on this site is meant to be believed without question or personal appraisal.

COPYRIGHT DISCLAIMER: Citation of articles and authors in this report does not imply ownership. Works and images presented here fall under Fair Use Section 107 and are used for commentary on globally significant newsworthy events. Under Section 107 of the Copyright Act 1976, allowance is made for fair use for purposes such as criticism, comment, news reporting, teaching, scholarship, and research.

COMMUNITY GUIDELINES DISCLAIMER: The points of view and purpose of this video is not to bully or harass anybody, but rather share that opinion and thoughts with other like-minded individuals curious about the subject.