Published Date: January 15th, 2026 | Updated January 19th, 2026 💢

SPECIAL REPORT

TRUTH///AWAKENING///DISCLOSURE

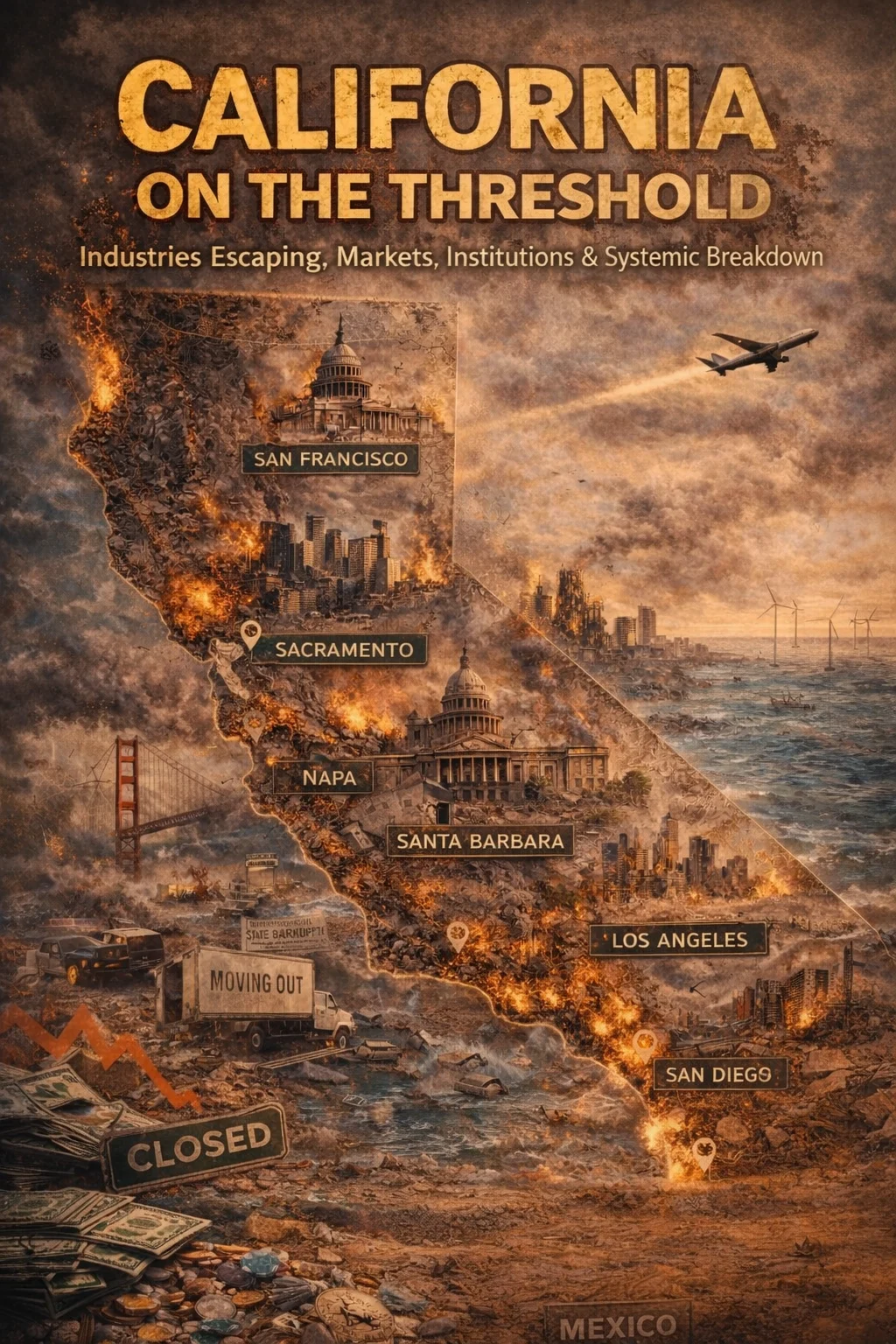

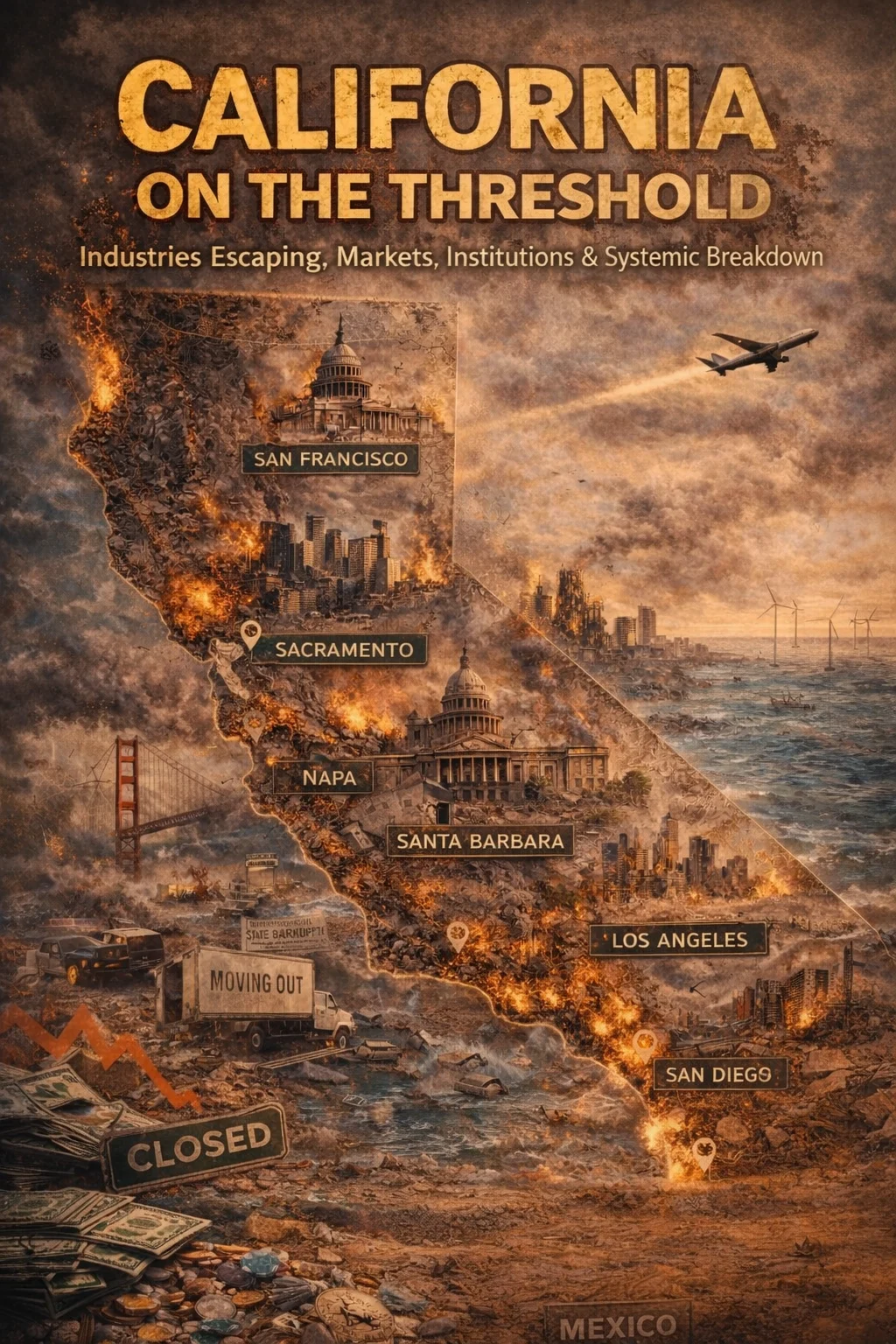

THE GREAT EXODUS, CALIFORNIA ON THE THRESHOLD

Industries Escaping, Systems Failing, and the End of the Golden State Model

“Every great exodus follows the same law: when governance, economy, and environment lose coherence,

capital, labor, and consciousness quietly withdraw—not in panic, but in precision. “Systems do not fail all at once—they fail for those paying attention first. Exodus is not abandonment; it is rational exit from unsustainable design.”

The Plan • First Wave • Compression Breakthrough • Deconstruction Pressure • Signal Saturation • System Shedding • Reorientation Phase

Introduction

California has long been treated as an exception—an economic engine so large, innovative, and culturally dominant that its internal contradictions could be deferred indefinitely. That assumption has expired. What is unfolding is not a recession, a policy misstep, or a cyclical downturn, but a systemic collapse driven by converging pressures across industry, capital, labor, governance, infrastructure, environment, and trust. The defining signal is not failure alone, but exit—industries leaving, capital reallocating, families relocating, and institutions losing relevance through non-participation.

This report documents the moment when stress stops being absorbed and begins to reorganize reality. As insurance withdraws, real estate reprices, grids strain, municipalities retrench, and public systems fragment, the Golden State model reveals its limits. These failures do not arrive in isolation; they arrive as signal saturation—a density of events so high that denial becomes mathematically impossible. What once appeared as unrelated problems now resolve into clear threads, and those threads form patterns.

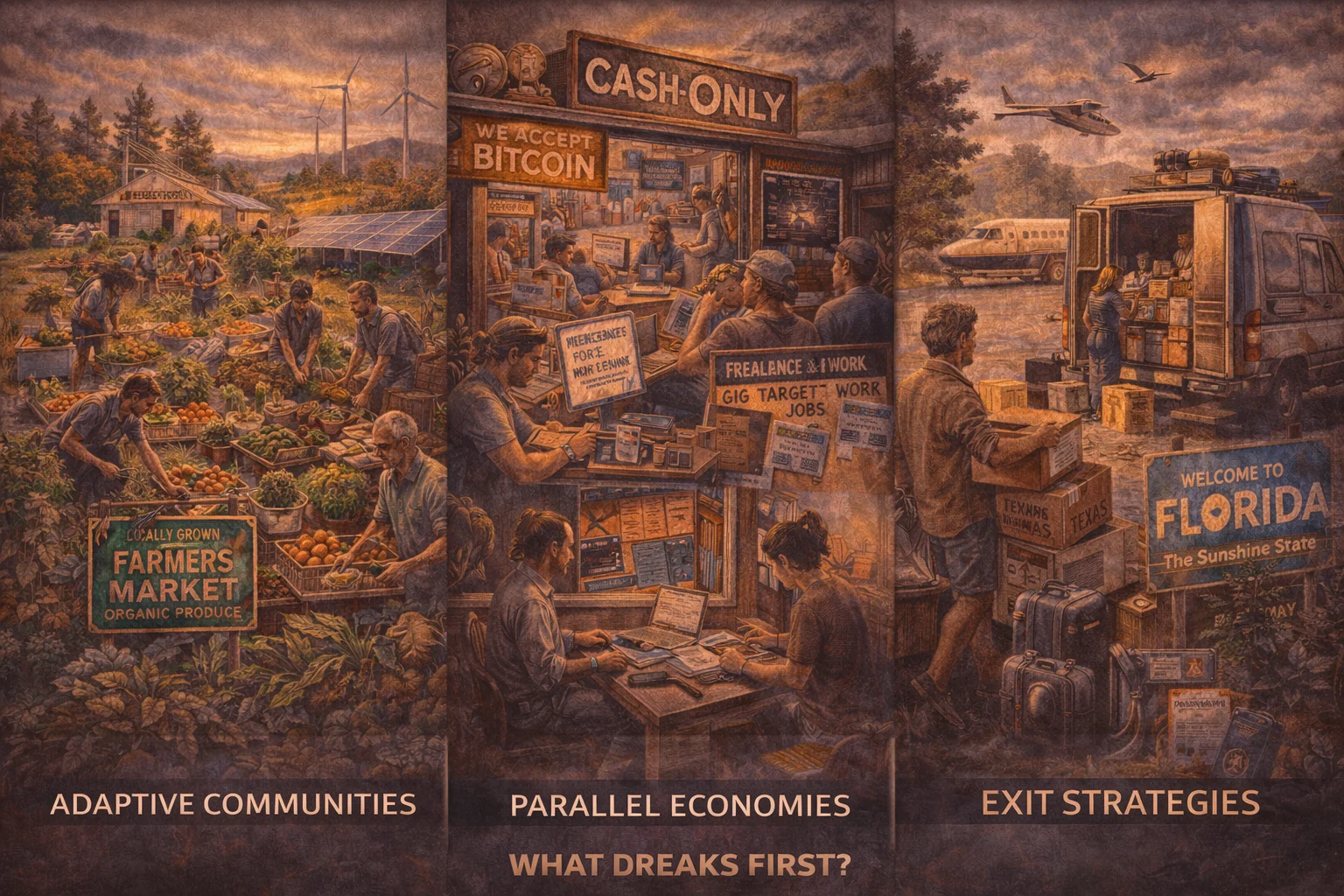

Collapse, in this framework, is not chaos—it is compression. Timelines accelerate. Consequences arrive faster. Systems that relied on delay, leverage, and narrative management lose the ability to buffer. This is the First Wave: awareness driven not by ideology or belief, but by lived experience—insurance cancellations, business closures, service cuts, migration decisions. As pressure stacks across domains, legacy structures begin shedding—not because they are attacked, but because they are no longer chosen.

What follows is not uniform collapse, but selective continuity. Some systems fail outright; others shrink, localize, or reconfigure. Parallel economies emerge. Adaptive communities form. Individuals and enterprises prioritize mobility, liquidity, and alignment over permanence. This report is not a warning—it is a map. It tracks signals, connects patterns, and outlines The Plan as it is already unfolding: dissolution where rigidity remains, acceleration where adaptation aligns. The end of the Golden State model does not signal the end of California—it marks the threshold where illusion gives way to reorganization.

California On The Threshold

Industries, Markets, Institutions & Systemic Breakdown

Macro Overview

- California as the Epicenter of U.S. Systemic Collapse

- From Innovation Engine to Exit State

- Population, Capital & Corporate Flight Dynamics

Business & Industry

- Corporate Headquarters Exodus

- Technology Sector Retrenchment & Layoff Cycles

- Venture Capital & Startup Funding Collapse

- Film, Television & Entertainment Industry Breakdown

- Manufacturing & Industrial Base Exit

- Transportation, Logistics, Ports & Supply Chain Contraction

- Aerospace & Defense Industry Decline

- Agriculture Collapse: Water Scarcity, Labor & Farm Failures

- Energy Sector Instability & Grid Risk

- Retail, Consumer & Lifestyle

- Environmental & Natural Systems

- Labor, Workforce & Informal Economies

- Emerging / Shadow / Transitional Markets

Real Estate Markets

- Commercial Office Real Estate Collapse

- Retail Shopping Centers & Mall Extinction (Retail Tenants)

- Industrial Real Estate Stress & Vacancy

- Multifamily Market Distortions & Rent Control Effects

- Residential Housing Bubble & Affordability Crisis

- Construction, Housing & Built Environment

- Insurance Withdrawal & Property Devaluation

Immigration As A Network Infiltration Vector

- Migration volume overwhelms screening, creating systemic blind spots

- Identity dilution via document fraud, reused addresses, and ghost employers

- Dense safe-house and short-term housing networks enable rapid mobility

- Cartel logistics drive drugs, human smuggling, and cash conversion

- Hybrid gangs merge retail theft, intimidation, and cartel methods

- Extremist and foreign-state facilitation remains low-visibility and embedded

- Ports, logistics corridors, and retail zones enable laundering at scale

- Institutional overload and fragmented enforcement expand network freedom

Cartel, Criminal, and Foreign-State Network Penetration

- Major Mexican Cartels (Brief Overview | CA Cartels)

- System Saturation and Screening Blind Spots

- Identity Dilution and Documentation Abuse

- Safe-House Density and Embedded Housing Networks

- Cartel Logistics, Trafficking, and Cash Conversion

- Hybrid Gangs and Mobile Criminal Crews

- Extremist and Foreign-State Facilitation Nodes

- Ports, Transportation Corridors, and Retail Crime Ecosystems

- Money Laundering Through Cash-Front Businesses

- Institutional Overload and Enforcement Fragmentation

- Conditional Escalation and Latent Network Risk

Financial Systems

- Banking Exposure & Regional Bank Risk

- Municipal Debt, Pension Liabilities & Insolvency

- Bond Market Confidence Erosion

- State & Local Tax Revenue Collapse

Labor & Employment

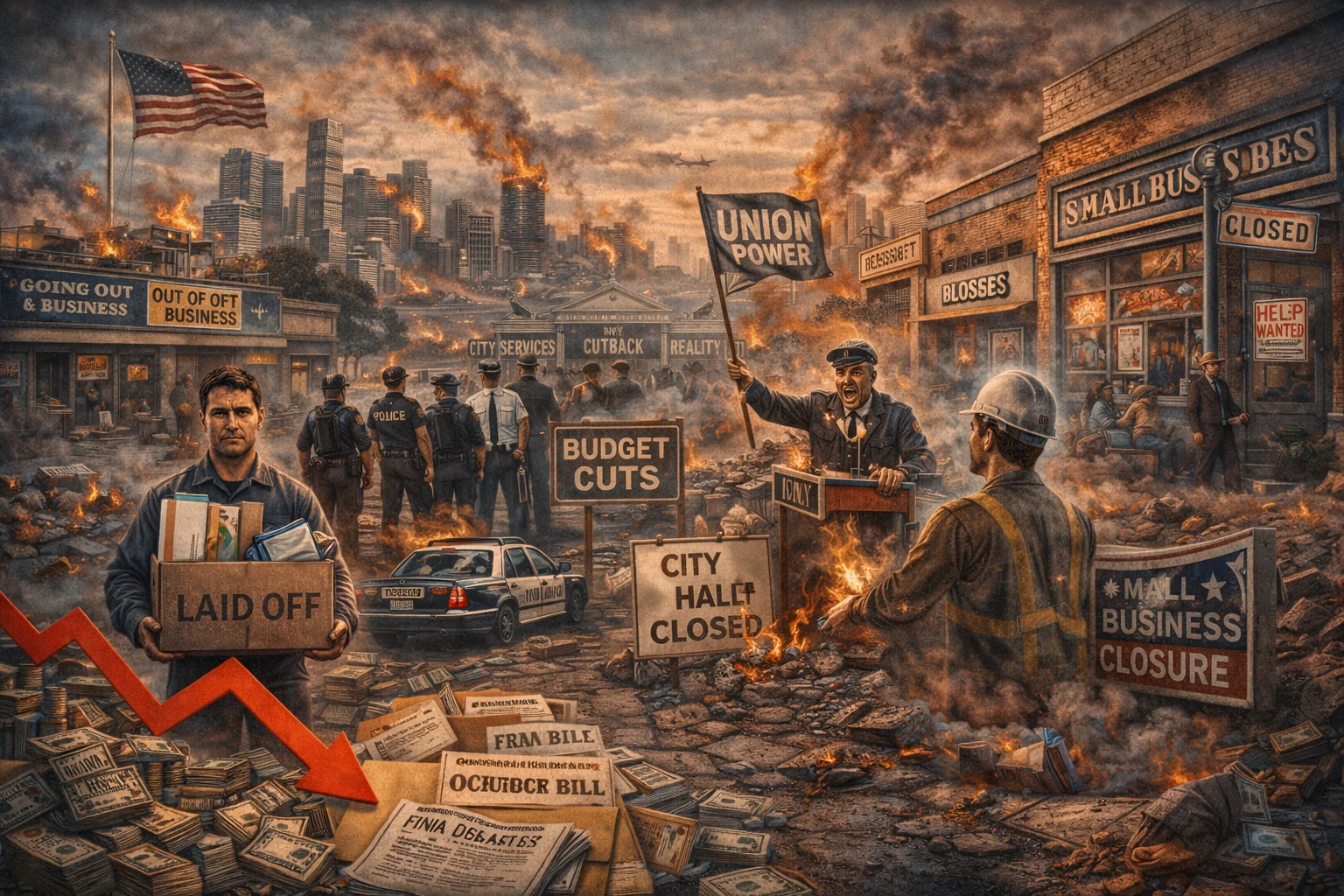

- Middle-Class Job Loss & Wage Compression

- Public Sector Layoffs & Budget Cuts

- Union Power vs Economic Reality

- Small Business Closures & Main Street Collapse

Government & Institutions

- State & Local Government Dysfunction

- Regulatory Overreach & Business Hostility

- Judicial System Backlogs & Trust Erosion

- Law Enforcement Attrition & Public Safety Decline

- Prison, Parole & Justice System Stress

- New Tax Laws, Rates & Fees

Education Systems

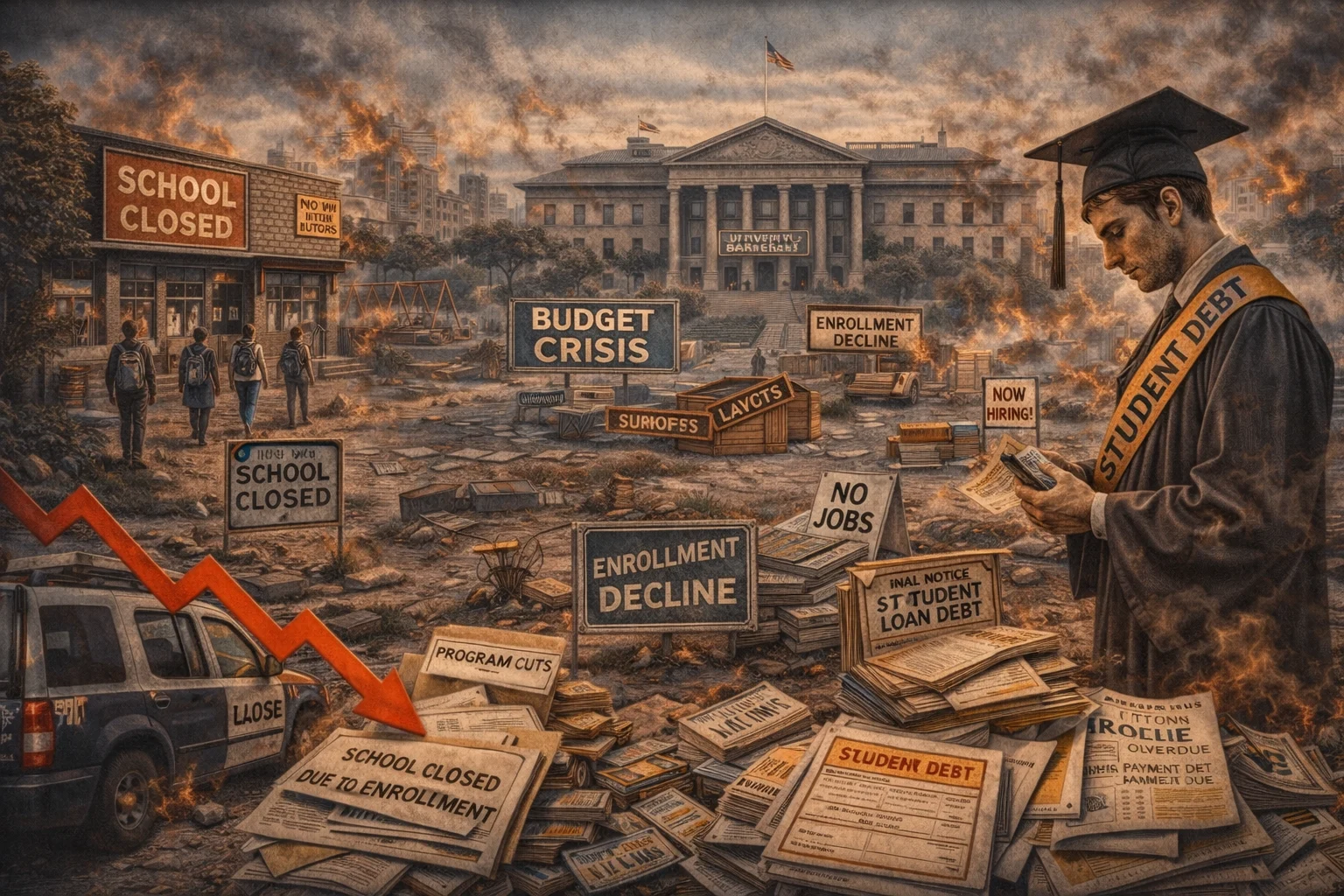

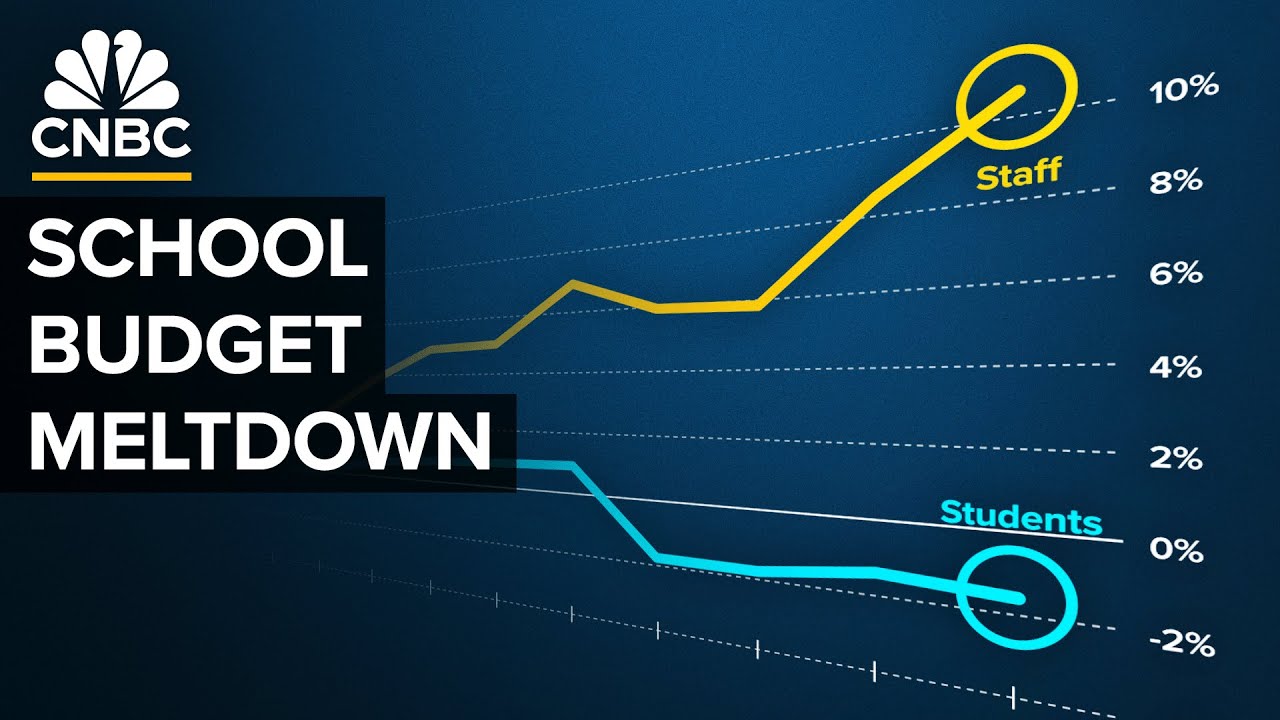

- Public School Enrollment Collapse

- University Budget Crises & Enrollment Declines

- Student Debt vs Employment Reality

Healthcare Systems

- Hospital Closures & Staff Shortages

- Insurance Market Breakdown

- Mental Health, Addiction & Care System Overload

Social Systems

- Homeless Industrial Complex (55 sq. blocks in downtown LA)

- Drug Crisis, Open-Air Markets & Public Disorder

- Cost of Living vs Quality of Life Breakdown

- Systemic Seniors Crisis

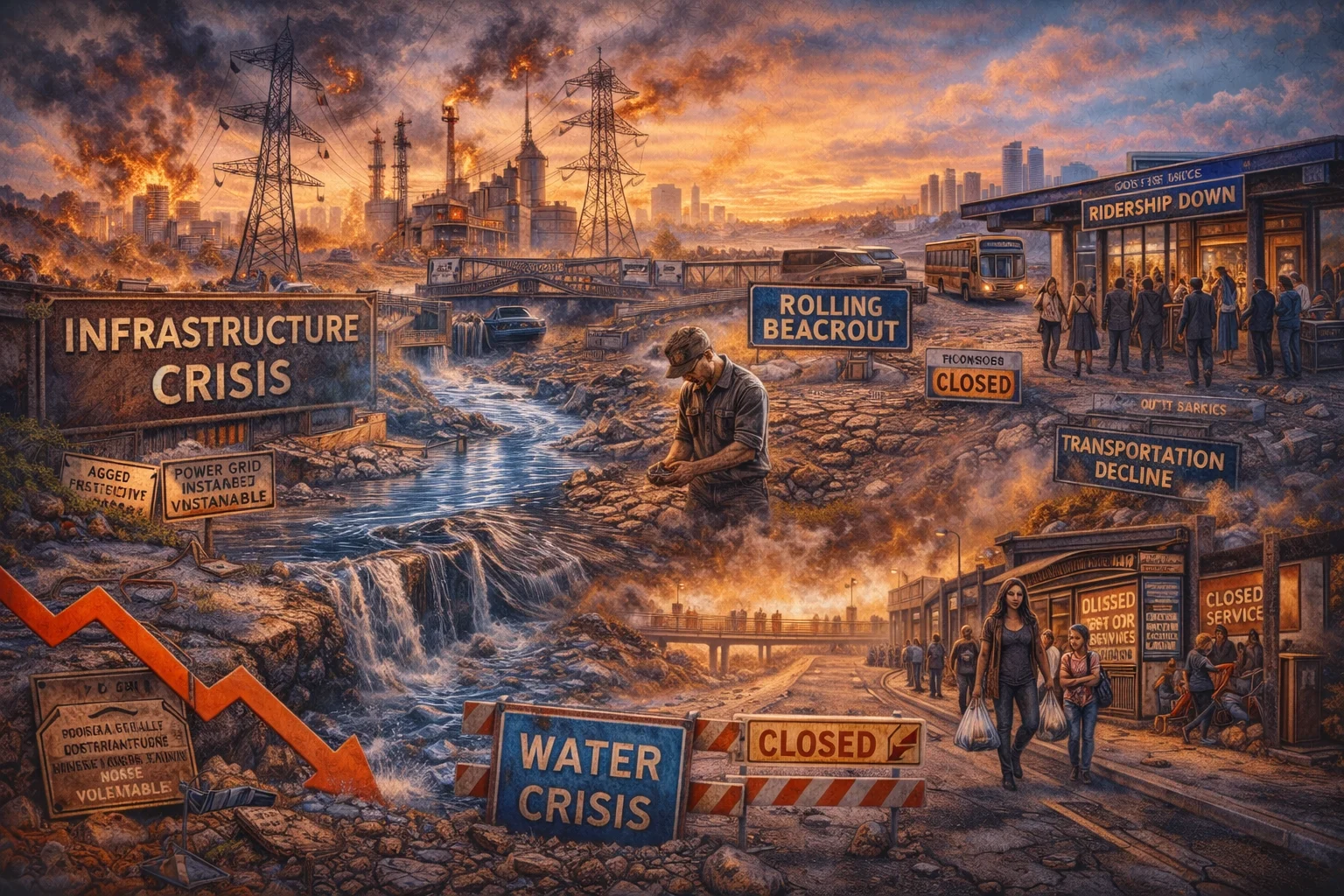

Infrastructure

- Aging Infrastructure & Deferred Maintenance

- Power Grid Instability & Rolling Failure Risk

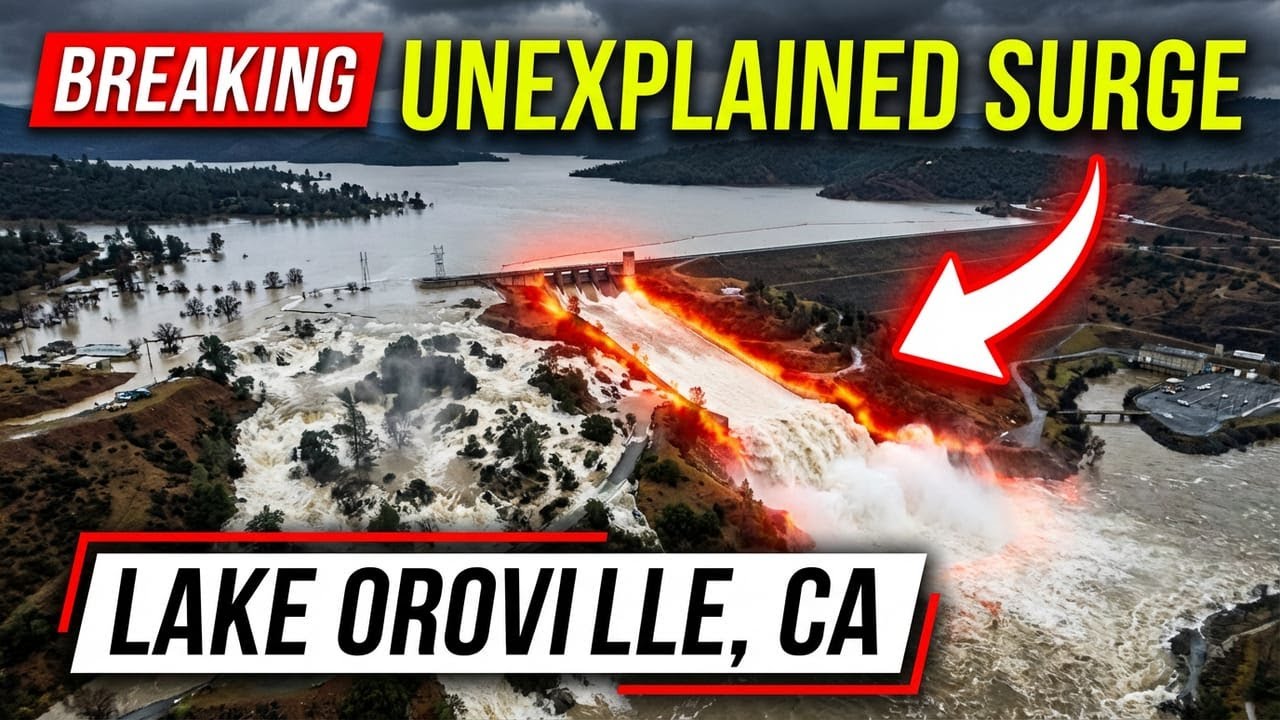

- Water Systems, Drought & Allocation Conflict

- Transportation Decline & Public Transit Losses

Climate, Environmental & Risk Factors

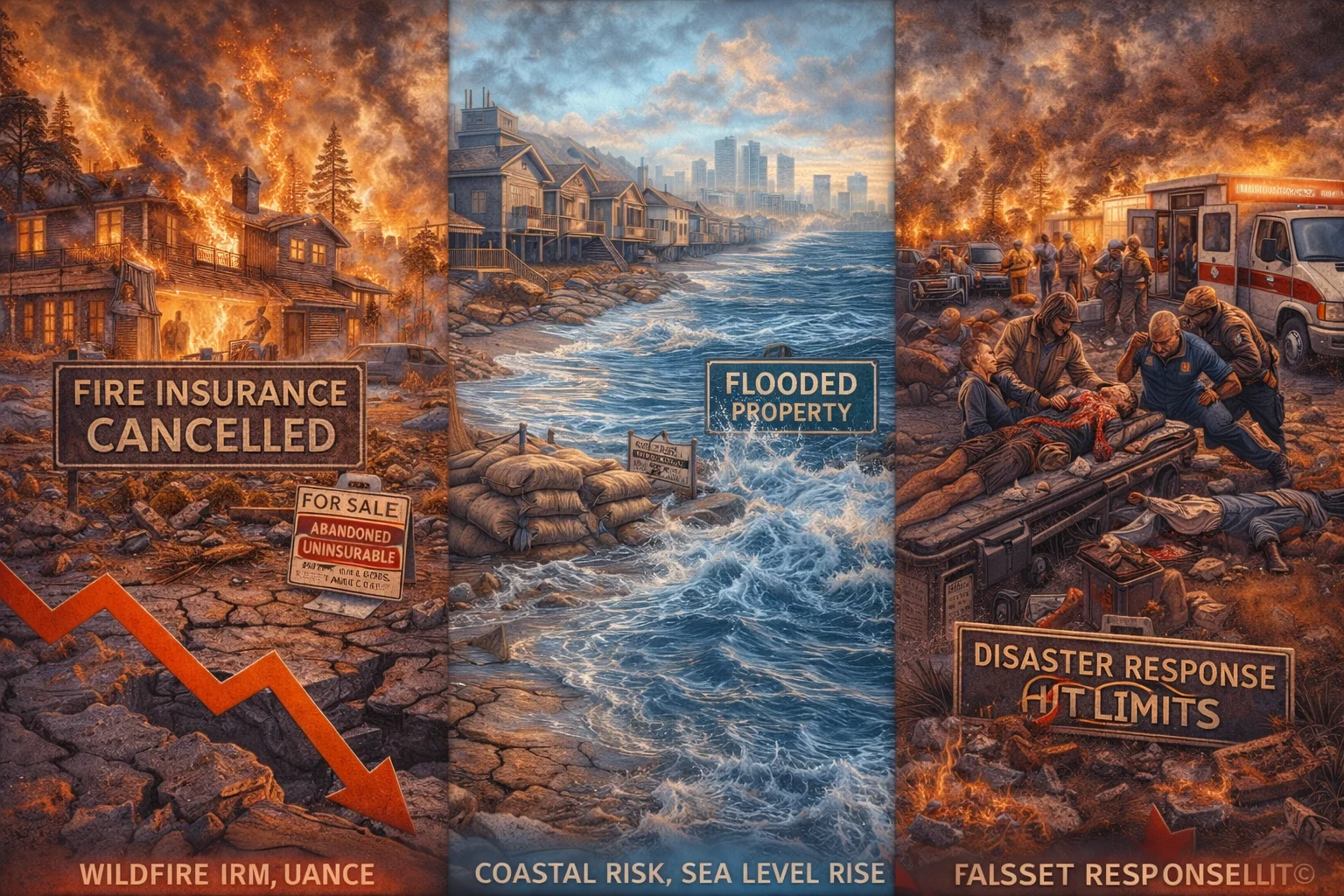

- Wildfire Insurance Crisis & Property Abandonment

- Coastal Risk, Sea-Level Exposure & Asset Write-Downs

- Disaster Response Capacity Limits

Geophysical, GeoWeather & Weather Control Technology

- Escalating Geophysical Volatility

- Earthquakes: Swarms, Fault Lines & Rising Strain

- Ocean-Floor Volcanic Activity & Tsunami Risk

- Coastal risk is amplified by:

- Extreme Weather Amplification & GeoWeather Instability

- Weather Modification & Atmospheric Intervention Technologies

- Convergence Risk: When Systems Lose Predictability

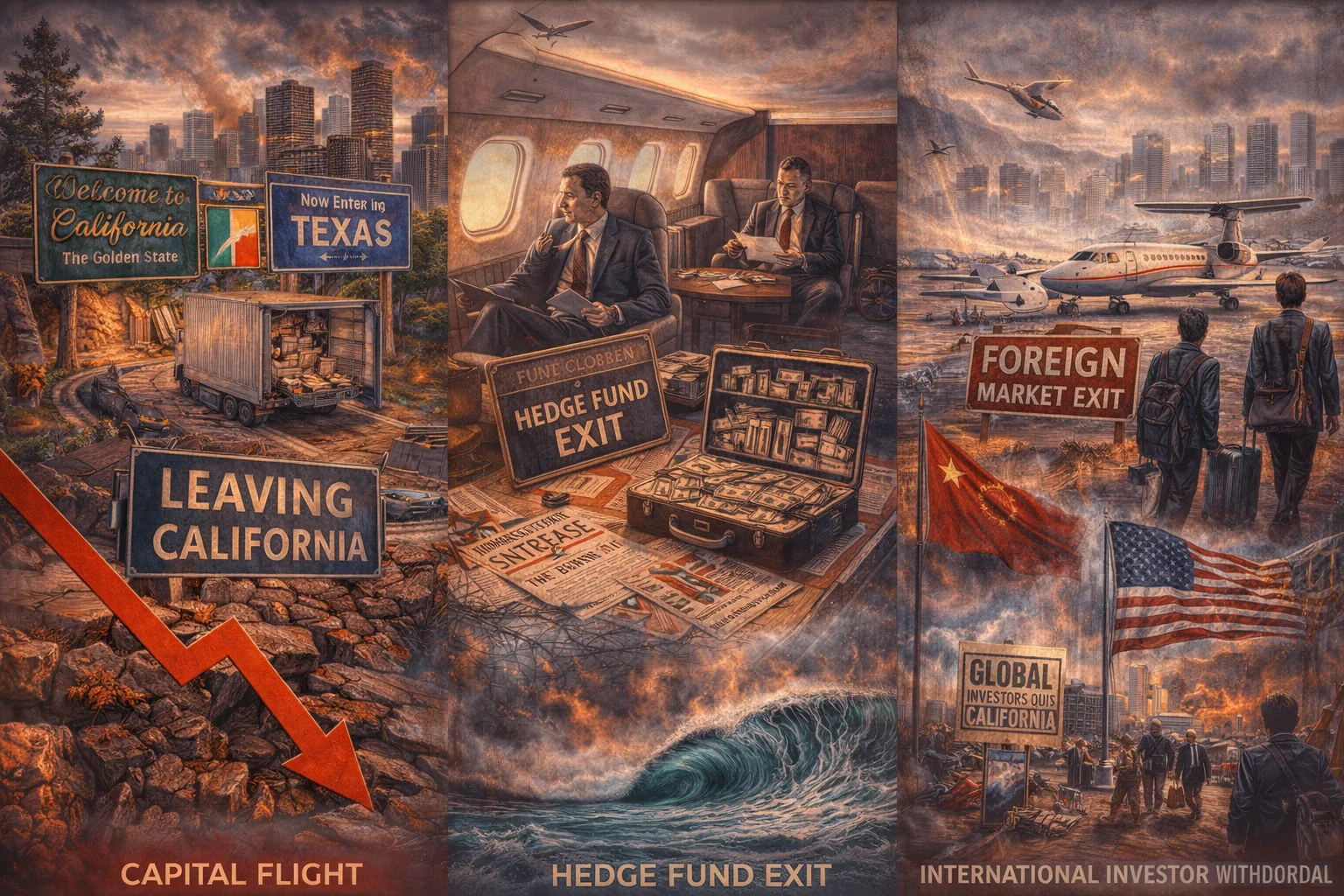

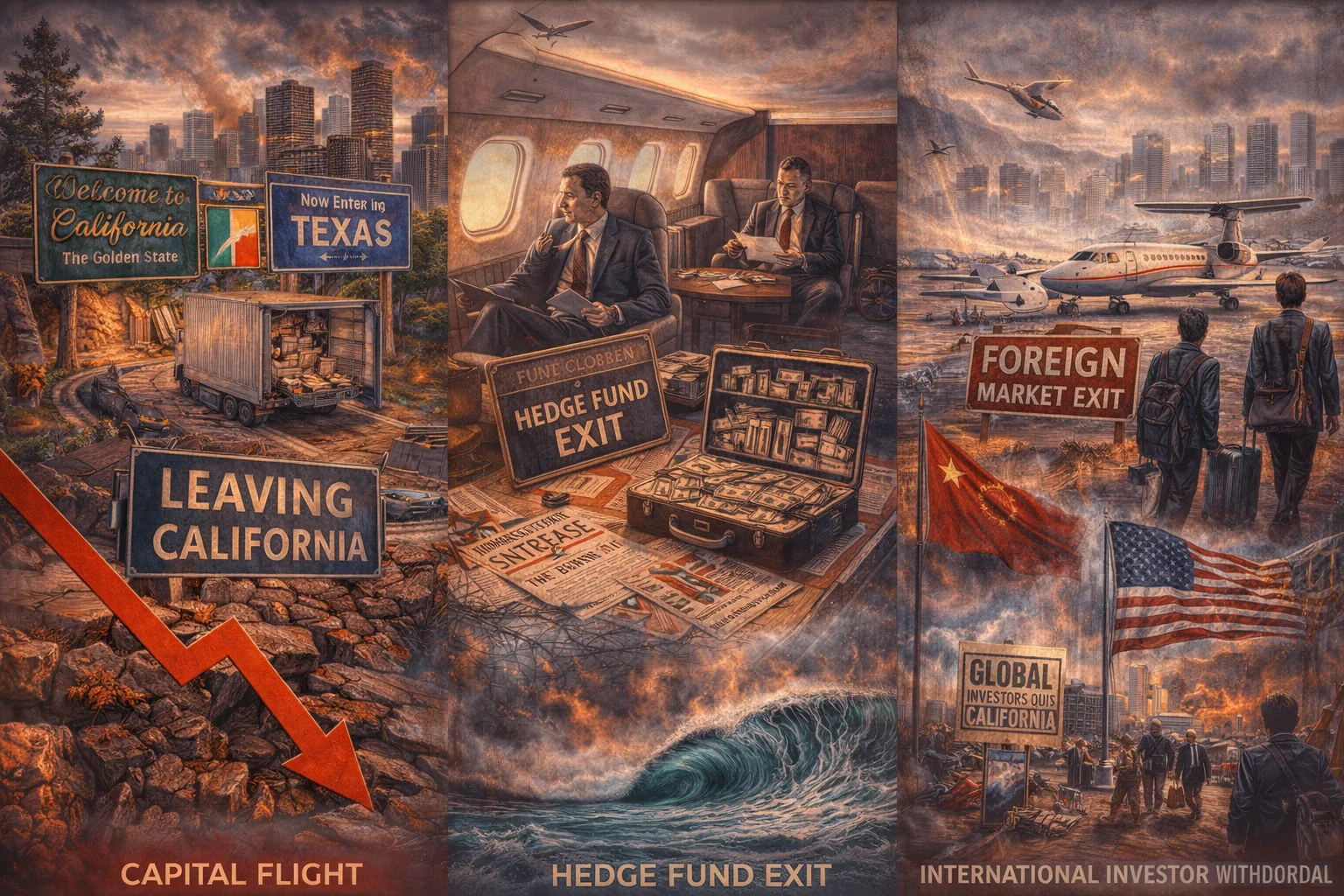

Capital Flows

- Capital Flight to Red States

- Private Equity, Hedge Fund & Family Office Exit

- California Pension Crisis

- International Investor Withdrawal

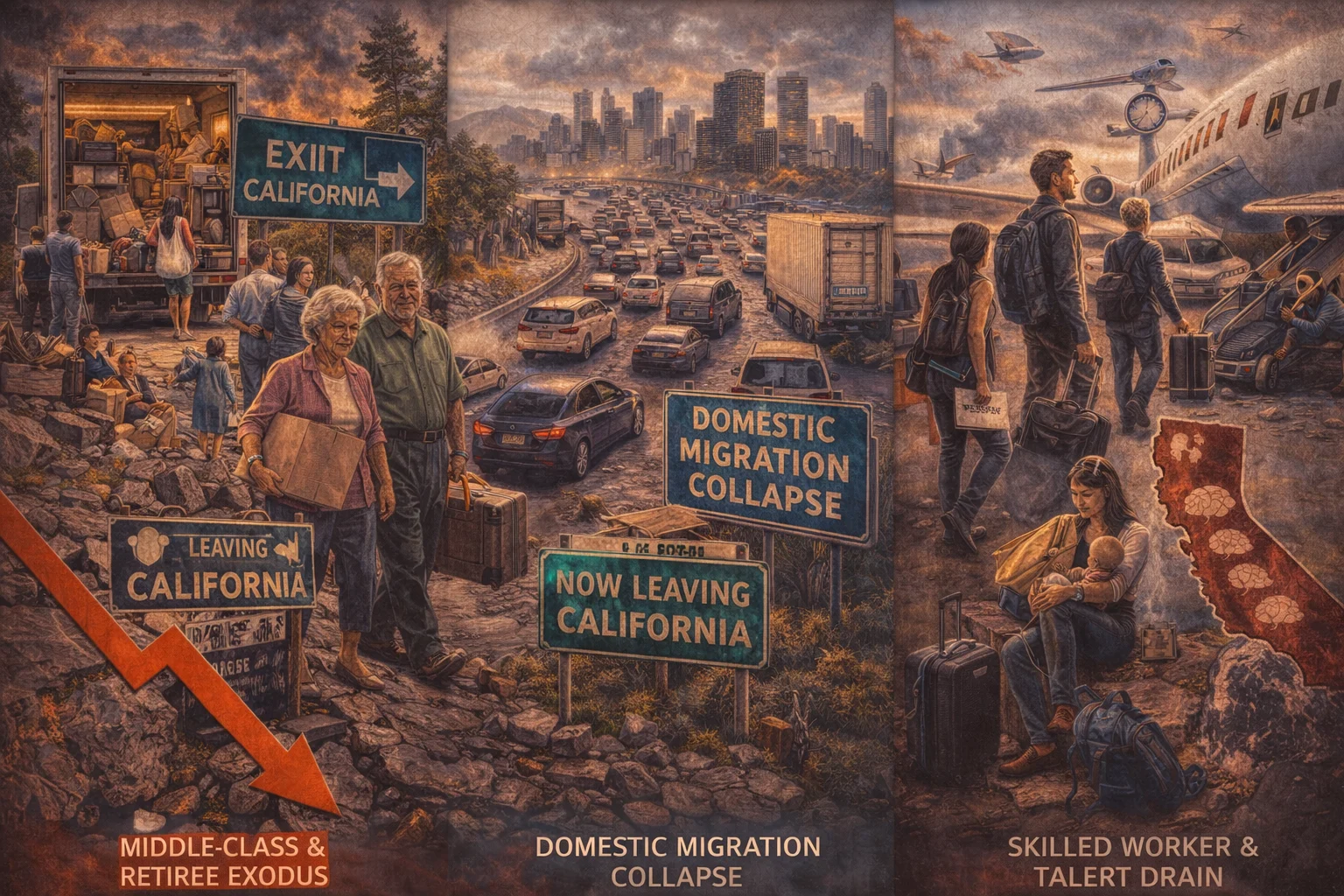

Demographic Shifts

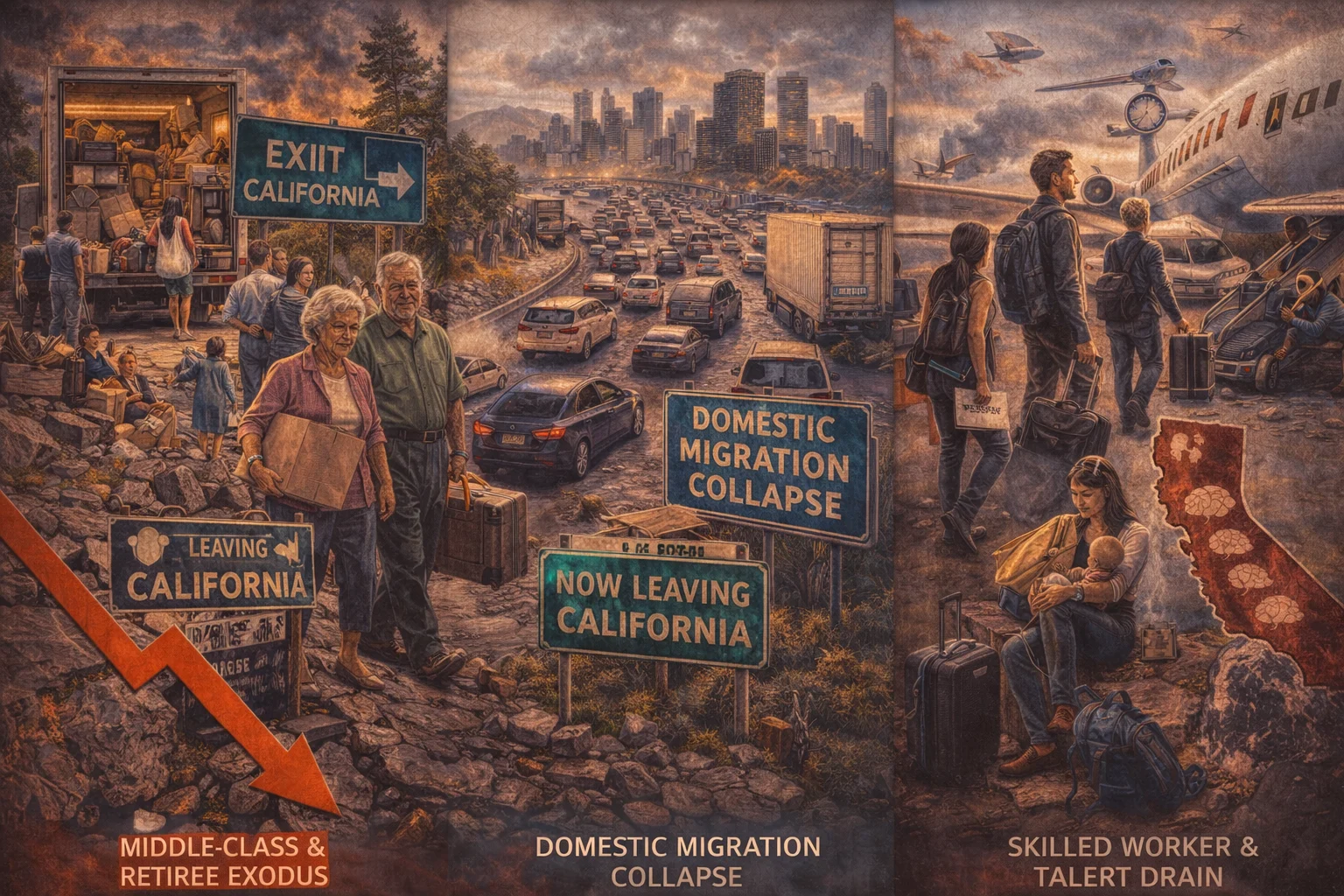

- Middle-Class & Retiree Exodus

- Net Domestic Migration Collapse

- Skilled Worker & Talent Brain Drain

- New Billionaire Tax Rates Forcing Exodus

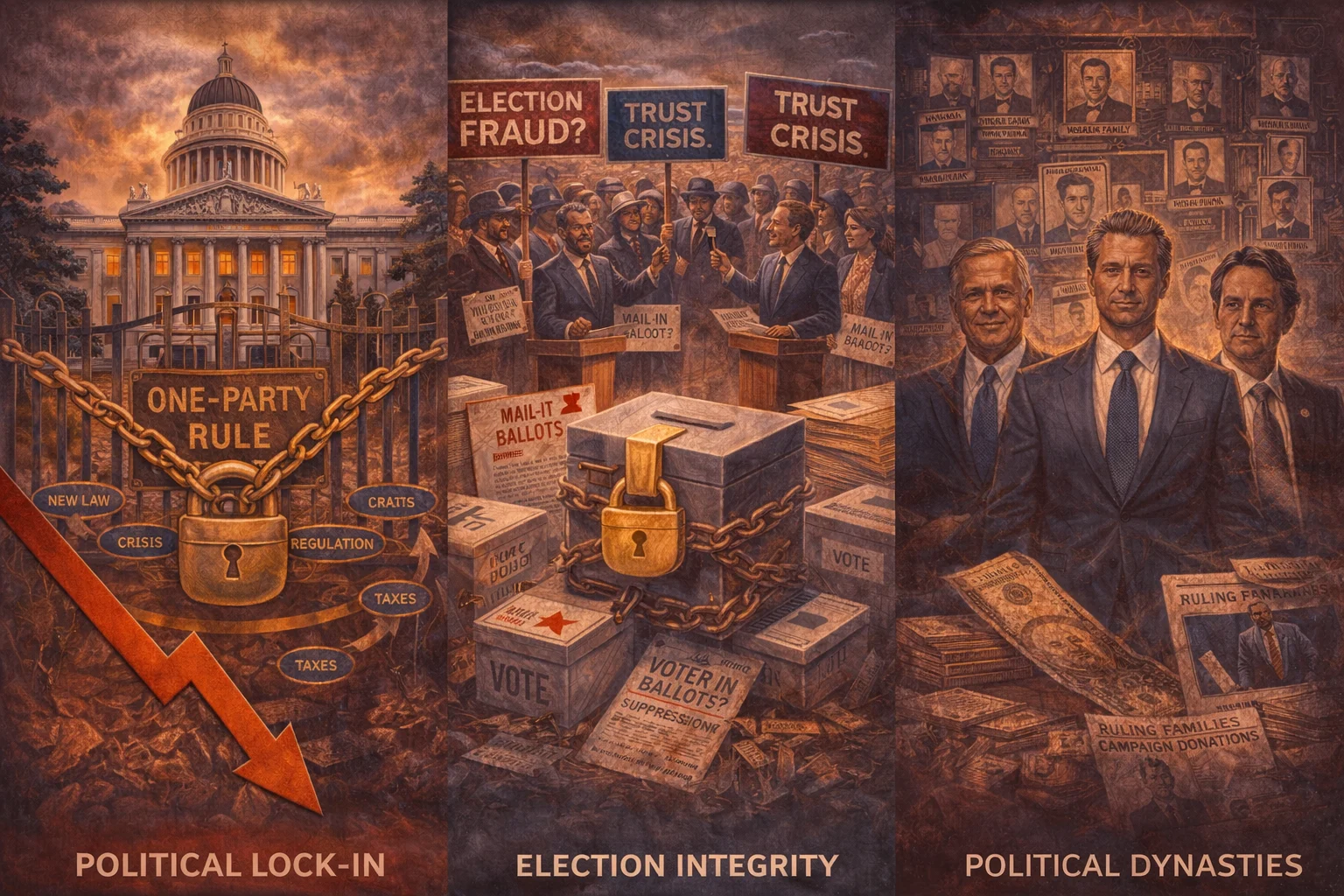

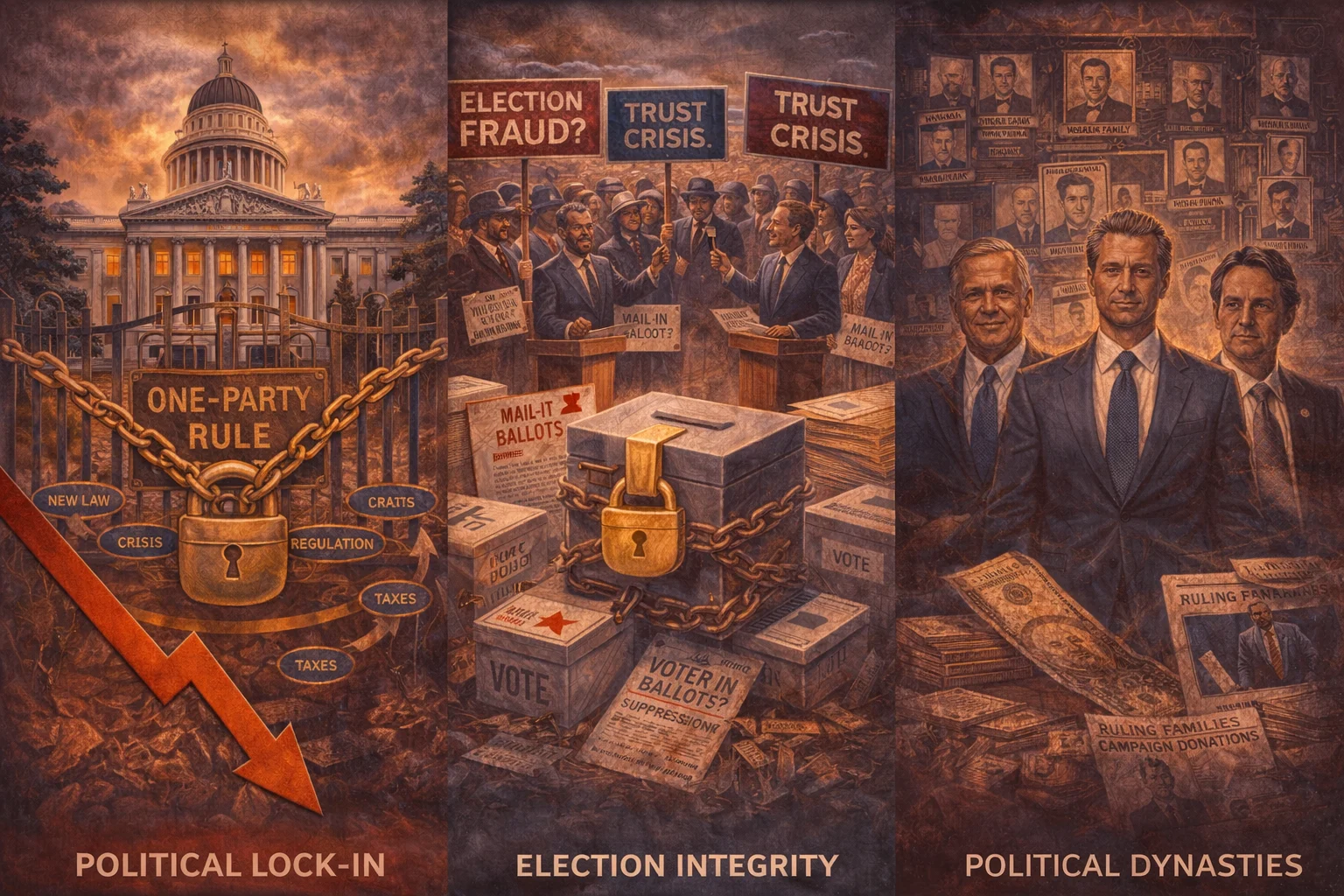

Political Economy

- Policy Feedback Loops & Structural Lock-In

- One-Party Governance & Risk Blindness

- Political Dynasties & Entrenched Leadership

- Election Integrity & Trust Erosion

- Ideology vs Economic Viability

Transition & Adaptation Signals

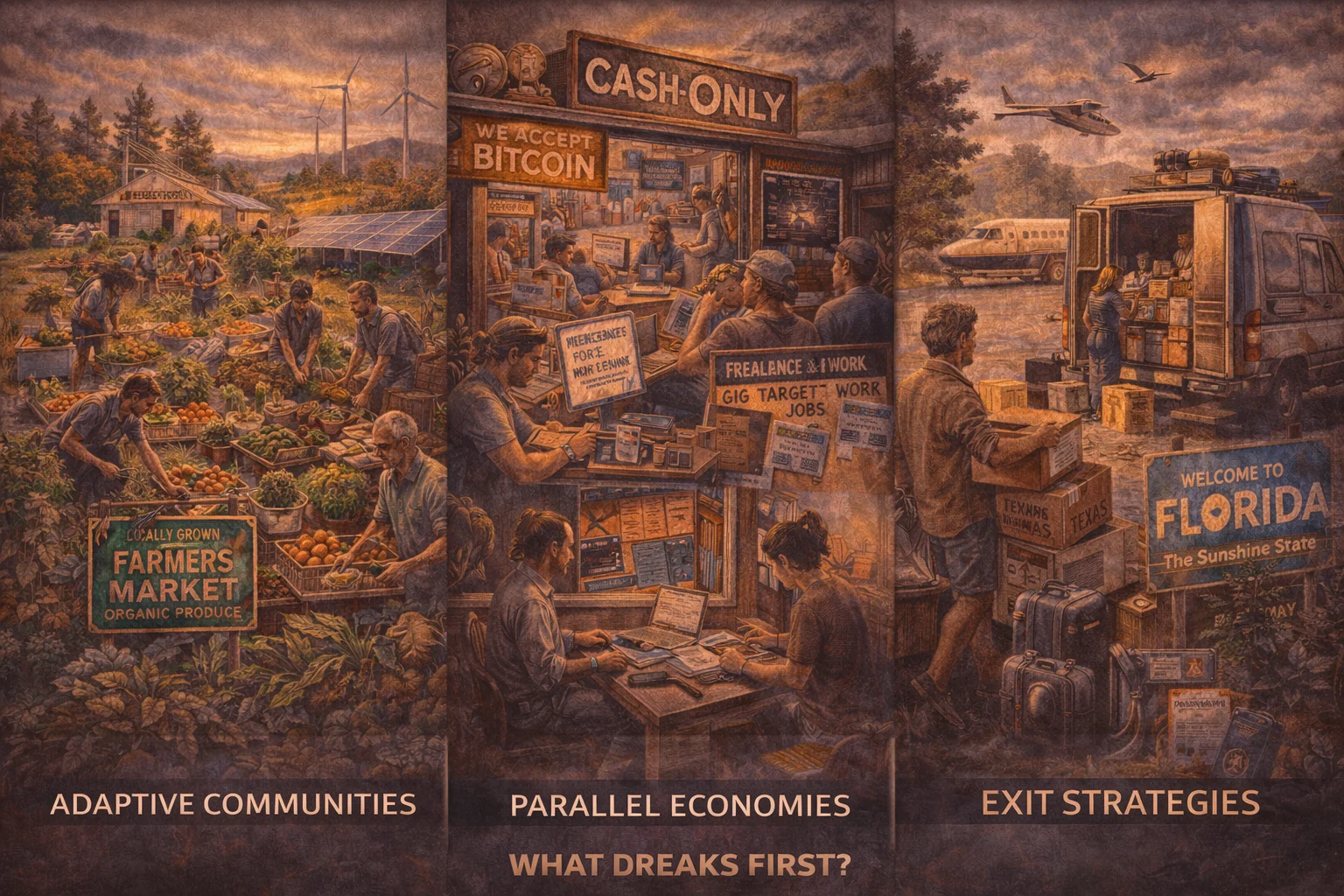

- Adaptive Communities & Parallel Economies

- Business Relocation Case Studies

- Individual Exit, Hedging & Mobility Strategies

Forward Outlook

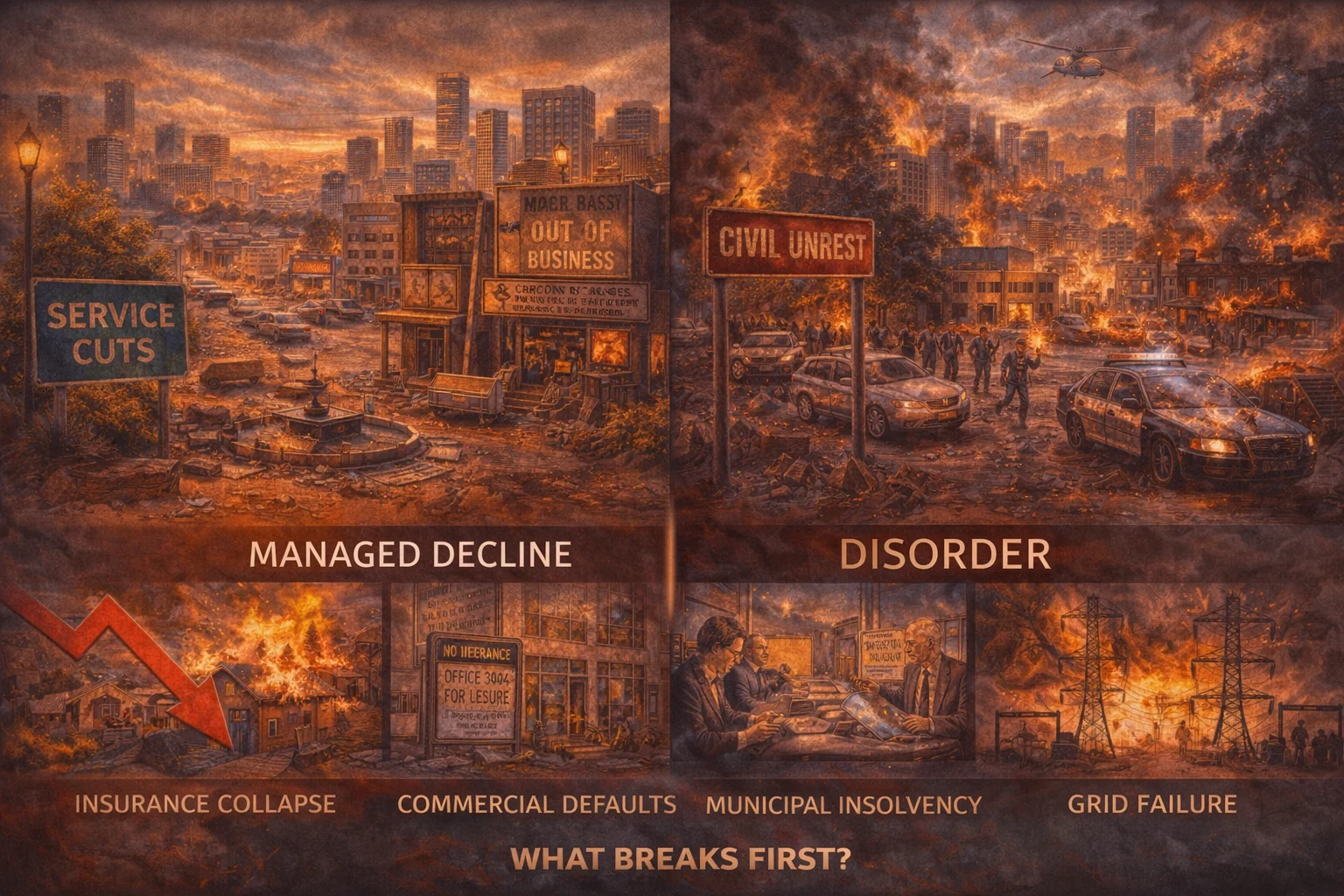

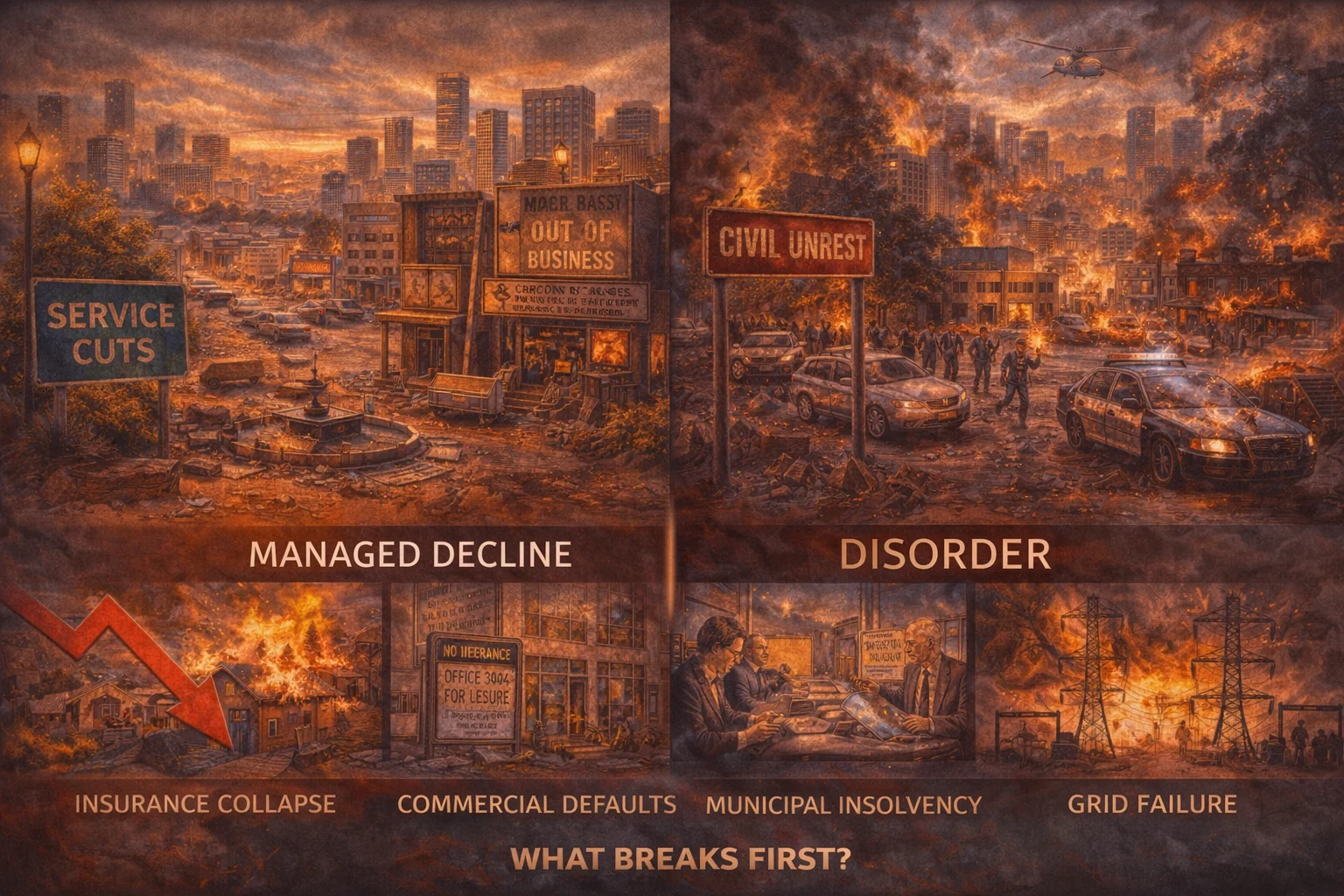

- Timeline Scenarios: Managed Decline vs Disorder

- What Breaks First — and What Follows

- Lessons for Other States & Nations

The Great Exodus, California On The Threshold Audio Review

“When truth emerges, illusions shatter. As the old world crumbles, a new one rises—built on sovereignty, wisdom, and the unbreakable power of unity.”

In this audio review, we walk through the key themes and signals from our special report The Great Exodus: California on the Threshold. Rather than covering every detail, this conversation highlights the major patterns shaping California right now — from economic and governance strain to population shifts and infrastructure stress — and why these developments matter beyond the state itself. The goal of this review is to help listeners quickly grasp what’s changing, what’s converging, and why California may be offering an early preview of broader national trends.

Macro Overview

California as the Epicenter of U.S. Systemic Collapse

California is not simply experiencing localized economic stress; it is functioning as the lead indicator for national systemic breakdown. What unfolds in California tends to appear elsewhere 12–36 months later, making the state a real-time stress test for policy, markets, and institutions. Extreme concentration of capital, population, regulation, debt, and ideological governance has compressed failure cycles, causing multiple systems—housing, insurance, labor, energy, governance, and public safety—to fracture simultaneously rather than sequentially.

Unlike past regional downturns, California’s collapse is multi-vector and self-reinforcing. Revenue shortfalls weaken services, regulatory rigidity accelerates business exits, population loss erodes tax bases, and institutional responses lag reality. This convergence places California at the center of the U.S. systemic unraveling, not because it is unique, but because it reached structural limits first.

From Innovation Engine to Exit State

For decades, California operated as America’s innovation engine—capital formation, technological breakthroughs, entertainment dominance, agricultural scale, and cultural influence all flowed outward from the state. That model depended on three conditions: talent inflow, capital confidence, and regulatory tolerance. All three have now reversed.

Today, California increasingly functions as an exit state, where companies incubate just long enough to relocate operations, headquarters, or intellectual property elsewhere. High costs, legal exposure, energy instability, taxation, labor rigidity, and political unpredictability have shifted executive decision-making from expansion to extraction. The state still produces ideas—but no longer retains the structures needed to monetize them long-term.

This transition marks a structural inflection point: when innovation remains but ownership, profits, and employment migrate elsewhere, economic hollowing accelerates beneath the surface.

Population, Capital & Corporate Flight Dynamics

The collapse dynamic is best understood through flow analysis, not headlines. California is experiencing synchronized outflows across three critical vectors:

-

Population Flight: Middle-class families, retirees, and skilled workers are leaving due to affordability, safety, education quality, and declining quality of life. This is not cyclical migration—it is permanent relocation.

-

Capital Flight: Private equity, family offices, venture capital, and foreign investors are reallocating to lower-risk jurisdictions. Capital now prices California as a regulatory and political risk premium, not a growth premium.

-

Corporate Flight: Headquarters relocations, remote-first strategies, and asset spin-offs allow firms to maintain market access while severing physical and tax exposure to the state.

These flows interact recursively: fewer taxpayers mean higher burdens on those who remain; higher burdens accelerate more exits. Once this loop reaches scale, recovery through policy alone becomes mathematically improbable.

Why This Section Matters

This macro overview sets the foundation for the entire report. It explains why California’s collapse is not a singular failure, but a compressed systems failure—economic, institutional, demographic, and psychological. Every subsequent section—real estate, labor, finance, infrastructure, healthcare, education—should be read as an expression of these upstream dynamics.

California is not falling apart randomly.

It is unwinding precisely where limits were exceeded first.

California Population Collapses | 2.3 Million People Flee in Largest Migration Since Dust Bowl

Welcome to David Ashwell.On this channel, we explore economics, markets, and global developments—and how they impact everyday life—using clear and straightfo...

Is California About to Collapse? Peter Zeihan Weighs In.

Is California about to collapse? Peter Zeihan Weighs InIn this captivating video, join renowned geopolitical strategist Peter Zeihan as he and Keith Weinhold...

The Damage Is Done: California Crosses the POINT OF NO RETURN Under Gavin Newsom | Patrick Buchanan

The Damage Is Done: California Crosses the POINT OF NO RETURN Under Gavin Newsom | Patrick Buchanan

The Ruthless Rise & Fall of California

California’s economy is massive. If it was an independent nation it would be the fifth largest by GDP. In the Span of 150 years California went from a far flung Mexican territory with only 150,000 people, to arguably the most influential piece of land on the entire earth. Yet today it has the highest poverty rate when adjusted for cost of living, thousands of large companies are moving out, and for the first time in its history it lost population in 2020.

California’s Biggest Problem | It’s Getting Worse

California is facing a growing number of problems that are affecting millions of residents and reshaping daily life across the state. In this video, we explore the 10 biggest problems in California, from the skyrocketing cost of living and severe housing shortage to the devastating homelessness epidemic and worsening drought and water scarcity.

Leave California now. (the implosion has begun)

Leave California now. (the implosion has begun)

California Exodus EXPLODES—U-Haul Just Revealed Where Everyone's Going EXPOSED

California isn’t just “changing” — people are literally loading up trucks and leaving. For the 6th year in a row, U-Haul’s one-way rental data shows California at the bottom, with more moves OUT than IN. In this video, we break down the “escape route map” (where people are going first vs. where they end up), the affordability stack driving the exits (housing, insurance, utilities, gas), and the part most coverage misses: what breaks in the local economy when middle-class spending power disappears.

Business & Industry

Corporate Headquarters Exodus

California is experiencing a sustained departure of corporate headquarters as firms relocate executive leadership, legal domicile, and tax exposure to lower-cost, lower-risk states. This is not symbolic relocation; it reflects a structural reassessment of long-term viability under California’s regulatory, tax, labor, and litigation environment. While some companies maintain operational footprints or satellite offices, strategic control increasingly resides elsewhere—reducing state tax revenues, executive employment, and downstream professional services.

Technology Sector Retrenchment & Layoff Cycles

The technology sector, once California’s primary growth engine, has entered a prolonged retrenchment phase. Layoffs are no longer cyclical corrections but part of a deeper recalibration driven by rising operating costs, remote-work normalization, capital discipline, and AI-driven labor compression. Talent still exists, but firms are decoupling innovation from location—retaining intellectual output while shedding physical and payroll exposure within California.

Technology & Innovation Sectors

- Big Tech (Platform Companies, Cloud, AI)

- Semiconductor & Hardware Manufacturing

- Artificial Intelligence & Data Services

- Biotechnology & Life Sciences

- Clean Tech & Climate Tech

- Defense Tech & Dual-Use Technology

- Autonomous Vehicles & Robotics

Venture Capital & Startup Funding Collapse

Venture capital flows have contracted sharply as investors prioritize capital preservation over speculative growth. Early-stage startups face higher funding thresholds, longer due-diligence cycles, and increased pressure to relocate before scaling. California is no longer the default launchpad; it is increasingly viewed as a high-burn environment unsuitable for early capital efficiency. This shift undermines the state’s startup pipeline and weakens long-term innovation density.

Financial & Professional Services

- Banking & Credit Unions

- Insurance (Property, Casualty, Health)

- Asset Management & Hedge Funds

- Accounting & Audit Services

- Legal Services

- Consulting & Advisory Firms

Film, Television & Entertainment Industry Breakdown

The entertainment industry is undergoing structural decline due to rising production costs, labor disputes, tax incentive competition from other states and countries, and platform consolidation. Studios are relocating filming, post-production, and even creative development outside California. As production leaves, secondary industries—set construction, hospitality, transportation, and creative freelancing—contract rapidly, hollowing out a once-dominant cultural and economic pillar.

Entertainment, Culture & Creative Economy

- Film & Television Production

- Streaming Platforms & Content Studios

- Music Industry

- Gaming & Interactive Media

- Live Events & Venues

- Influencer & Creator Economy

Manufacturing & Industrial Base Exit

Manufacturing in California has been steadily eroded by regulatory compliance burdens, energy costs, land prices, and labor constraints. What remains is increasingly specialized or legacy-based, lacking reinvestment incentives. Industrial exits weaken supply chain resilience and eliminate middle-income jobs, accelerating economic polarization. The loss of manufacturing capacity also reduces California’s ability to adapt during broader national or global supply disruptions.

Manufacturing & Industrial

- Advanced Manufacturing

- Aerospace & Defense Manufacturing

- Automotive & EV Manufacturing

- Electronics Manufacturing

- Industrial Equipment & Tools

- Chemical Manufacturing

Transportation, Logistics, Ports & Supply Chain Contraction

California’s transportation and logistics sector is under growing strain as trade volumes fluctuate, operating costs rise, and regulatory pressures intensify. Ports and maritime shipping face throughput volatility, labor disputes, and competition from faster, lower-cost out-of-state gateways. Trucking and freight operators are pressured by fuel costs, insurance, labor shortages, and compliance mandates, while rail transport contends with aging infrastructure and limited expansion capacity.

Warehousing and distribution remain active but increasingly margin-constrained as real estate costs, energy prices, and security risks rise. Airports and aviation services face declining discretionary travel alongside higher operating and staffing costs. Across the system, supply chain management is shifting away from California as companies seek more predictable, lower-cost logistics corridors, signaling a gradual erosion of the state’s historic role as a primary trade and distribution hub.

Transportation & Logistics

- Ports & Maritime Shipping

- Trucking & Freight

- Rail Transport

- Warehousing & Distribution

- Airports & Aviation Services

- Supply Chain Management

Aerospace & Defense Industry Decline

Once a cornerstone of California’s industrial and technological leadership, aerospace and defense operations are consolidating elsewhere. Security requirements, cost controls, and federal contracting pressures favor states offering lower overhead and greater political alignment. As facilities close or downsize, California loses high-skill engineering roles and strategic industrial relevance tied to national defense and advanced manufacturing.

- Legacy Industry Contraction and Facility Closures

- Defense Contractor Relocation and Consolidation

- Federal Contracting and Compliance Pressures

- Cost Structure and Regulatory Burden

- Security, Clearance, and Operational Constraints

- Loss of High-Skill Engineering and Technical Talent

- Advanced Manufacturing and Supply Chain Erosion

- Strategic National Defense Relevance Decline

- Talent Migration to Lower-Cost Defense States

- Long-Term Impact on Innovation and R&D Capacity

Agriculture Collapse: Water Scarcity, Labor & Farm Failures

California agriculture faces compounding pressures: water scarcity, regulatory water restrictions, rising labor costs, land reclassification, and climate volatility. Small and mid-sized farms are failing or selling, while production shifts to other states or countries. The collapse of agricultural predictability threatens food security, rural economies, and export revenues—transforming one of California’s most foundational industries into a systemic vulnerability.

Agriculture, Food & Resource Industries

- Wine Industry Collapse (Vineyards, Wineries, Distribution)

- Specialty Crops (Almonds, Pistachios, Citrus, Berries, water shortages)

- Dairy & Livestock

- Food Processing & Packaging

- Agricultural Labor & Farm Services (immigrant deportation)

- Water-Intensive Farming Systems

- Fisheries & Aquaculture

Energy Sector Instability & Grid Risk

California’s energy system is under continuous stress from policy transitions, aging infrastructure, peak demand volatility, and insufficient baseload replacement. Grid instability, rising utility costs, wildfire liabilities, and rolling outage risk undermine industrial confidence. Energy uncertainty acts as a force multiplier across all sectors—deterring investment, accelerating exits, and increasing operational fragility statewide.

Energy, Utilities & Infrastructure

- Electric Utilities & Power Generation

- Renewable Energy (Solar, Wind, Battery Storage)

- Oil & Gas (Production, Refining, Distribution)

- Water Infrastructure & Water Rights Markets

- Grid Infrastructure & Transmission

- Waste Management & Recycling

Retail, Consumer & Lifestyle

California’s retail, consumer, and lifestyle sectors are experiencing structural contraction driven by declining discretionary spending, rising operating costs, organized retail theft, and shifting consumer behavior. Brick-and-mortar retail faces sustained store closures as foot traffic erodes and insurance, security, and rent costs rise. E-commerce and direct-to-consumer models continue to absorb market share, but are now encountering margin compression, logistics costs, and customer acquisition fatigue.

Luxury goods and fashion are showing early demand softening as high-income consumers pull back amid market volatility, while grocery and food retail are squeezed between price-sensitive consumers and rising supply, labor, and shrinkage costs. Hospitality, tourism, restaurants, and food service are increasingly vulnerable to labor shortages, insurance costs, regulatory pressure, and declining discretionary travel. Together, these dynamics signal a sector shifting from growth to survival mode, with consolidation, closures, and selective transformation accelerating across California’s consumer economy.

Retail, Consumer & Lifestyle

- Brick-and-Mortar Retail

- E-Commerce & Direct-to-Consumer

- Luxury Goods & Fashion

- Grocery & Food Retail

- Hospitality & Tourism

- Restaurants & Food Service

Environmental & Natural Systems

California’s environmental and natural systems sector is under increasing pressure as climate volatility, regulatory complexity, and funding constraints converge. Forestry and timber operations are constrained by permitting delays, litigation risk, and land-use restrictions, while fire management and mitigation efforts struggle to keep pace with the scale and frequency of wildfire events. The growing cost of prevention, response, and recovery is placing sustained strain on both public budgets and private insurers.

Climate adaptation services and environmental consulting are expanding in response to regulatory mandates and risk exposure, but growth is uneven and highly dependent on government funding cycles. Carbon markets and offsets continue to evolve, yet face credibility challenges, pricing volatility, and regulatory uncertainty. Together, these dynamics reflect a sector caught between rising environmental risk and limited institutional capacity to manage it effectively.

Environmental & Natural Systems

- Forestry & Timber

- Fire Management & Mitigation

- Climate Adaptation Services

- Environmental Consulting

- Carbon Markets & Offsets

Labor, Workforce & Informal Economies

California’s labor and workforce systems are fragmenting as cost pressures, regulatory burdens, and demographic shifts reshape employment structures. Unionized labor markets face rising wage demands, pension liabilities, and increasing tension with employers seeking cost control or relocation. At the same time, the gig economy and contract labor continue to expand, offering flexibility but also creating income instability and limited worker protections.

Undocumented labor markets remain deeply embedded in agriculture, construction, hospitality, and service sectors, complicating enforcement and wage dynamics. Service sector employment is under sustained pressure from declining discretionary spending, automation, and business closures. Skilled trades face a growing shortage as aging workers retire and training pipelines fail to replenish critical technical roles, further constraining economic resilience.

Labor, Workforce & Informal Economies

- Unionized Labor Markets

- Gig Economy & Contract Labor

- Undocumented Labor Markets

- Service Sector Employment

- Skilled Trades

Emerging / Shadow / Transitional Markets

California’s emerging and shadow markets are expanding in parallel with regulatory complexity, economic strain, and institutional retreat. The legal cannabis industry continues to struggle under taxation, compliance costs, and enforcement gaps, allowing illicit operators to retain significant market share. Psychedelic and alternative medicine markets are growing in visibility and demand, but remain fragmented, unevenly regulated, and vulnerable to legal and financial uncertainty.

Private security and risk services are expanding as businesses and communities compensate for perceived gaps in public safety and enforcement. The data brokerage and surveillance economy is scaling rapidly, driven by demand for consumer intelligence, risk profiling, and behavioral analytics, often operating ahead of clear regulatory oversight. Informal cash economies are increasing as individuals and small businesses seek liquidity, privacy, and flexibility outside traditional financial systems, signaling broader confidence erosion in formal institutions.

Emerging / Shadow / Transitional Markets

- Cannabis Industry (Legal & Illicit Overlap)

- Psychedelic & Alternative Medicine Markets

- Private Security & Risk Services

- Data Brokerage & Surveillance Economy

- Informal Cash Economies

Why This Section Matters

Business and industry breakdown is not an isolated phenomenon—it is the primary transmission mechanism through which population loss, tax base erosion, real estate collapse, and institutional strain accelerate. Once core industries disengage, recovery shifts from economic to structural, requiring timelines measured in decades rather than cycles.

California Governor STUNNED as Tesla Announces Massive Factory Shutdown | Sophia Miller

🚨 Breaking News from California! California’s Governor is left stunned as Tesla drops a shocking announcement: a massive factory shutdown that could resha...

California Pipeline Closes, 100 Trucks Hit Roads: What Happens Next? | Steve Layton

California's fuel system is under pressure, not because demand has fallen, but because the path from oil to fuel has narrowed. What happens when pipelines sh...

Governor Of California LOSES IT After Stellantis SHUTS DOWN Factory In California!

In this video, we look at the escalating political and economic tensions in California, as Governor Gavin Newsom faces mounting pressure after Stellantis reportedly revealed plans to relocate key parts of its operations outside of the state. ves straight to Sacramento.

Major Casinos Begin Shutting Down | California Wasn’t Ready for This

Major Casinos Begin Shutting Down — California Wasn’t Ready for This, California's $17 billion casino industry is facing an unprecedented crisis as casinos close, cities face bankruptcy, and a legal war threatens over 117,000 jobs.

California's Strategic Pipeline Dies | 100,000 Barrels Daily Lost as Energy Infrastructure Collapses

The San Pablo Bay pipeline that carried crude oil from Bakersfield to Bay Area refineries for 70 years shut down permanently after losing $2 million monthly. With no alternatives at scale, Northern California refineries face supply shortages that could trigger fuel crises across the West Coast.

EXODUS From California: Governor Newsom's Policies BACKFIRE As Giants Like Chevron FLEE!

A dramatic account of Governor Gavin Newsom's political journey from his triumphant 2021 recall election victory to the corporate exodus that followed his aggressive progressive agenda.

California Governor Blocks Local Oil Imports From Saudi Arabia

California has become heavily dependent on foreign crude oil imports despite producing substantial volumes domestically, particularly in Kern County, which supplies roughly seventy percent of the state’s in-state oil output. The permanent shutdown of the San Pablo Bay Pipeline eliminated a key link between Central Valley oil fields and Bay Area refineries, forcing refiners to rely on imported crude from countries including Iraq, Saudi Arabia, Ecuador, and Brazil.

Governor Of California LOSES IT After Apple ANNOUNCES Plans To Leave California!

In the most devastating blow yet to California's innovation economy, Apple Inc. announced plans to relocate its corporate headquarters from Cupertino to Austin, Texas over the next seven years—ending nearly five decades of California-based leadership. The move affects 36,000 employees and eliminates $8.7 billion in annual economic activity from the state that created Silicon Valley.

California Loses Another Major Company | Oracle's $200B Exit Explained!

In January 2019, Oracle paid $200 million to put their name on the San Francisco Giants ballpark. A 20-year commitment. 23 months later, they announced they were leaving California for Texas. But here's where it gets wild.

Governor Of California LOSES IT After Boeing SHUTS DOWN Factory In California!

In this video, we look at the dramatic repercussions from Governor Gavin Newsom's apparently outraged response to Boeing's bombshell statement. Kelly Ortberg, the company's CEO, recently unveiled plans that could see Boeing significantly reduce — or perhaps relocate — major operations out of California, sending shockwaves through the state's political and economic leadership.

Governor of California RESPONDS After 70,000 Truckers Are Quitting Overnight

Governor of California RESPONDS After 70,000 Truckers Are Quitting Overnight.

California Governor Blocks Local Oil, Imports From

December 2025. California's critical oil pipeline shuts down permanently. Hundreds of thousands of barrels of domestic crude from Kern County — oil that's already being pumped from California soil — can no longer reach Bay Area refineries. The result? Refineries are now importing crude from Iraq, Saudi Arabia, and Ecuador instead. Oil travels 8,000 miles across the Pacific Ocean while California's own supply sits just 300 miles away. This isn't theory. This is happening right now.

California Dumps Billions Of Gallons Of Fresh Water Into Ocean—Thousands Of Farmers Face Bankruptcy

1289- DiscoverglobeCalifornia Dumps Billions Of Gallons Of Fresh Water Into Ocean—Thousands Of Farmers Face BankruptcyDiscover Globe is back with a story tha...

Governor Of California PANICS As Fish He CHOSE OVER FARMERS GOES EXTINCT!

Governor Of California PANICS As Fish He CHOSE OVER FARMERS GOES EXTINCT!

For seventeen years California has been diverting billions of gallons of fresh water away from farms and cities to protect a three inch fish called the Delta Smelt. The total cost to Central Valley farmers exceeds ten million acre feet of water - valued at approximately five billion dollars.

California Is About to Lose 20% of Its Gas Supply—What Happens Next? | CA Energy Innovation Forum

As California continues investing in clean energy, the gradual decline of in-state refineries is drawing attention. In this episode, a panel explores how thi...

Trump Declares Energy War on California | Newsom Fights Back as Gas Crisis Deepens

Welcome to David Ashwell.On this channel, we explore economics, markets, and global developments—and how they impact everyday life—using clear and straightfo...

Governor Of California Loses Control After ExxonMobil Gas Refineries Begins Shutdown In State!

California’s gas supply is spiraling toward a crisis as major refineries move to shut down or idle operations — including Valero’s massive Benicia plant and Phillips 66’s Los Angeles refinery — cutting a huge share of California’s gasoline production and threatening record-high prices at the pump. The state’s unique gasoline blend and lack of pipeline access make it even harder to replace lost fuel, forcing reliance on expensive imports just to cover demand.

California FORCING Another Refinery SHUTDOWN: Taxpayers Face Gas Price DOOM Loop in 2026

California's regulatory war on the oil industry. Watch as we break down how excessive taxation and environmental regulations are driving refineries out of the state while Governor Newsom pretends to be shocked at the consequences of his own policies.

Gas at $10? California Dems PANIC as Refineries Flee the State!

California is on the brink of a major gas crisis. With Valero—responsible for 20% of the state’s refining capacity—set to shut down operations, gas prices are projected to hit $8 or even $10 a gallon. In this video, Phil breaks down why refineries are leaving, how California’s environmental regulations and CARB’s policies are driving this crisis, and why Democrats in Sacramento are suddenly panicking.

CALIFORNIA COLLAPSE: Thousands Stranded as Fuel Supply Hits Zero (Newsom Hides)

🚨 BREAKING: The fuel crisis has shifted from "Expensive" to "Empty."Reports are flooding in from across California: Gas stations are bagging their pumps. It...

Governor Of California HYSTERIC After 473 Gas Stations FORCED To Close!

Governor Of California HYSTERIC After 473 Gas Stations FORCED To Close! Interested in reviewing the research behind this video? There's a complete list of the reliable sources I used in the comment section.

Governor of California PANICS After Amazon Quietly Freezes California Expansion

Amazon has not announced store closures or exits from California, but behind the scenes, something significant has changed.

Over the past year, multiple Amazon warehouse projects across California were delayed, downsized, or removed from development plans.

California Governor EXPLODES After Apple Announces MASSIVE Shut Down | Elizabeth

In a stunning move that strikes at the heart of Silicon Valley, Apple Inc. has announced it is relocating its corporate headquarters to Austin, Texas, ending nearly 50 years of California leadership. The decision delivers a devastating economic blow, taking 36,000 jobs and $8.7 billion in annual economic activity out of the Golden State over the next seven years.

Governor Of California PANICS After Netflix’s Secret Exit Strategy Is EXPOSED

In another devastating blow to California's entertainment economy, leaked documents revealed Netflix's plan to relocate its corporate headquarters and primary production operations from Los Gatos to Atlanta, Georgia over the next six years.

CALIFORNIA TECH COLLAPSE: Google Founder Flees as State Seizes "Voting Power"

It’s not just about "High Taxes." California has quietly activated a legislative "Kill Switch" for startups known as the Class B Share Valuation clause. This technicality forces founders like Larry Page (Google) and Andy Fang (DoorDash) to pay taxes on "Voting Power" as if it were liquid cash a mathematical impossibility.

Governor Newsom PANICS as Del Monte Declares Bankruptcy - California's Food Supply Is Collapsing

Governor Newsom PANICS as Del Monte Declares Bankruptcy - California's Food Supply Is Collapsing, helping viewers understand why a single corporate bankruptcy can signal deeper structural risks in the food supply chain. From an educational standpoint, the discussion explains how large agricultural processors influence pricing, availability, and stability across California, and why disruptions at this level quickly ripple out to farmers, retailers, and consumers.

Governor Of California PANICS After Disney’s Secret Exit Strategy Is EXPOSED

In a stunning reversal, leaked documents reveal Disney's plan to relocate its animation studios and corporate headquarters from California to Florida over the next six years. This massive shift affects 9,200 employees and eliminates $1.8 billion in annual economic activity from the state that built the Disney empire.

California Governor in Trouble After Coca-Cola Factory Shutdown | Elizabeth

Coca-Cola is making a move that doesn't seem to make sense. They just announced a massive $500 MILLION investment into a new California facility—the first in 60 years. But at the exact same time, they are permanently shutting down four historic plants and laying off hundreds of workers.

Governor Of California PANICS After Largest Brewery DUMPS $2 BILLION In Operations!

Governor Of California PANICS After Largest Brewery DUMPS $2 BILLION In Operations!

California's Bar Industry Is COLLAPSING | Here's What's Really Happening

California's Bar Industry Is COLLAPSING — Here's What's Really Happening, California's $4 billion bar industry is under siege. Iconic bars that survived for 20, 25, even 30+ years are closing their doors forever — and the reasons go far beyond what you've heard.

California’s Snack Industry Is CRACKING After PepsiCo’s Fritos Lays Factory Shutdown

A major PepsiCo Frito-Lay factory in Rancho Cucamonga, California has shut down after 55 years of continuous operation, instantly laying off 480 workers and sending shockwaves through the state’s manufacturing economy. The facility produced some of America’s most recognizable snack brands, including Lays, Doritos, Fritos, and Cheetos, supplying grocery stores across Southern California and the western United States.

Governor Of California FURIOUS as 103-Year-Old Coffee Giant Saves $18M by Fleeing to Texas

For more than a century, one company helped define the coffee America drank. Built in California in 1912, Farmer Brothers survived the Great Depression, two world wars, and decades of economic change—only to leave the state behind in 2015.

California systemic problems | Sign in California’s “Ghost Daycares” EXPOSED — Millions in Taxpayer Fraud Uncovered

Real Estate Markets

Commercial Office Real Estate Collapse

California’s commercial office market is undergoing a structural collapse rather than a cyclical downturn. Remote and hybrid work have permanently reduced demand, while high operating costs, taxes, insurance premiums, and deferred maintenance have made many buildings economically nonviable. Vacancy rates in major metros have reached levels where refinancing is impossible at current interest rates, triggering loan defaults, forced sales, and value write-downs of 40–70% or more. Office real estate, once a stable institutional asset class, has become a stranded asset across much of California.

Retail Shopping Centers & Mall Extinctions

Brick-and-mortar retail has moved beyond decline into extinction in many California markets. E-commerce adoption, reduced discretionary spending, crime, homelessness, and declining foot traffic have hollowed out shopping corridors and malls. Anchor tenant failures cascade into smaller retailer closures, leaving entire centers functionally obsolete. Redevelopment is often blocked by zoning, environmental review, or capital constraints, turning former retail hubs into long-term blight rather than transition assets.

Industrial Real Estate Stress & Vacancy

Industrial real estate—once considered California’s most resilient property sector—is now showing stress. Logistics rerouting, port inefficiencies, rising labor costs, and slower consumer demand have reduced warehouse absorption. At the same time, new supply delivered during the late-cycle expansion is colliding with declining tenant demand. Vacancy rates are rising, lease rates are softening, and valuations are beginning to reset, particularly in port-adjacent and inland logistics corridors.

Multifamily Market Distortions & Rent Control Effects

California’s multifamily housing market is heavily distorted by rent control, tenant protection laws, and regulatory constraints. While intended to preserve affordability, these policies have reduced new construction, discouraged maintenance investment, and driven small landlords out of the market. Operating costs—insurance, utilities, taxes, compliance—are rising faster than allowable rents, compressing margins and increasing loan stress. The result is deteriorating housing stock, reduced supply, and growing systemic risk within multifamily portfolios.

Residential Housing Bubble & Affordability Crisis

Residential housing in California reflects a classic late-stage bubble: prices disconnected from local incomes, affordability at historic lows, and transaction volume collapsing even as prices remain elevated. High mortgage rates, insurance costs, taxes, and utilities have pushed ownership out of reach for much of the middle class. Rather than correcting quickly, the market is stagnating—characterized by illiquidity, forced sales, and uneven regional declines that erode household wealth and mobility.

Insurance Withdrawal & Property Devaluation

The insurance market has become a primary driver of real estate devaluation in California. Insurers are withdrawing from wildfire, flood, and coastal-risk areas or sharply raising premiums and deductibles. Properties without insurable coverage become unfinanceable, instantly losing market value regardless of location or condition. This dynamic is creating invisible fault lines across residential, commercial, and multifamily markets—where insurance availability, not demand, determines asset viability.

Construction, Housing & Built Environment

California’s construction and built environment sector is entering a prolonged contraction as financing tightens, development costs rise, and demand weakens across both residential and commercial markets. Residential construction is slowing under the weight of affordability constraints, high interest rates, insurance challenges, and regulatory delays, while commercial construction faces declining office demand, retail closures, and capital withdrawal. Infrastructure construction remains active but increasingly dependent on public funding, long timelines, and cost overruns.

Architecture and engineering services are experiencing project delays and cancellations as developers pause or abandon planned builds. Building materials and supply chains face volatility from energy costs, transportation disruptions, and reduced order volumes. Property management services are absorbing rising delinquency, vacancy, and maintenance costs, signaling stress across the entire built environment as California transitions from expansion to preservation mode.

Construction, Housing & Built Environment

- Residential Construction

- Commercial Construction

- Infrastructure Construction

- Architecture & Engineering Services

- Building Materials & Supply Chains

- Property Management Services

Why This Section Matters

Real estate is the collateral backbone of California’s economy. As property values fall, insurance disappears, and loans default, losses propagate into banks, pensions, municipal budgets, and household balance sheets. Real estate collapse is not an isolated sectoral event—it is the mechanism through which financial, institutional, and social stress accelerates statewide.

The City of Las Vegas - Crashing

Welcome to the Scott Walters Podcast — your real-world guide to the hidden truths in real estate and the economy. I cut through the noise to reveal what the ...

Do NOT Buy in California 2026 – Kevin O'Leary WARNS!

Do NOT Buy in California 2026 – Kevin O'Leary WARNS!The California real estate market in twenty-twenty-six has become a "financial zombie" that threatens to ...

California Housing Market Crash | Why No One Can Afford A Home in California Anymore?

📉 California Housing Market Crash | Why No One Can Afford A Home in California Anymore?California’s Housing Crisis Just Got Worse...The California housing m...

California Housing Market January 2026 Update | Sacramento, LA, San Diego & Bay Area

California housing market January 2026 update covering Sacramento, Riverside, San Diego, Los Angeles, and San Jose/San Francisco. Latest housing trends, price outlook, buyer vs seller market analysis, and 2026 real estate predictions. Perfect for buyers, sellers, and investors looking to understand the future of California real estate.

Governor Newsom PANICS as California's Property Tax Revolt EXPLODES

Across California, homeowners and seniors are raising urgent concerns as property taxes continue to climb—sparking what many are calling a statewide pushback. In this video, we break down why Governor Newsom PANICS as California's Property Tax Revolt EXPLODES, what triggered this wave of frustration, and how these changes could impact your household budget.

LA's Most Prestigious Tower LOSES $338M, Goes Into Foreclosure Near Skid Row

Another day, another prestigious downtown skyscraper bites the dust — this time it's One California Plaza in Los Angeles, dropping a staggering 74% in value and heading straight into receivership. What a coincidence that this "gleaming" tower sits right next to Skid Row, where officials have concentrated decades of failed social policy into 54 blocks of visible human calamity.

California Gov PANICS After Realtor.com LEAVES California… No ONE NOTICED?

California Gov PANICS After Realtor.com LEAVES California… No ONE NOTICED? Welcome to House Crisis, today we go over: Realtor.com's Quiet Exit Tax and Cost Advantages Drive the Move Part of Massive Corporate Exodus, California's Economic Reversal, Housing Paradox and Future Implications

California Rental Crash: These 10 Cities Are Seeing the Biggest Rent Drops in 2025

California's rental market has completely flipped in 2025—and rents are dropping fast in cities that once seemed untouchable. From Los Angeles and San Francisco to Bakersfield and Riverside, discover the 10 California cities experiencing the steepest rental declines and what's really driving this unprecedented correction.

Socialists DESTROY Los Angeles Housing Market

n this video, I discuss the city of Los Angeles passing a so-called reform to their rent stabilization ordinance that unfortunately is a double down rather than any positive change in policy. I explain how the DSA essentially wrote this law to copy a failed policy from St. Paul Minnesota

California Sparks Outrage with $300M Home Loan Program for Illegal Immigrants

Article Summary: California's latest $300 million home loan scheme is igniting outrage as it opens eligibility to illegal immigrants, diverting taxpayer funds away from U.S. citizens. Critics argue that this program, part of the California Dream for All Shared Appreciation Loan initiative, exacerbates the state's housing crisis by increasing competition for already scarce homes.

California Exodus EXPLODES as More Residents Flee than Any Other State

FOX Business’ Max Gorden joins ‘Varney & Co.’ to report on new U-Haul data showing California leading the nation in outbound moves as Americans seek affordability elsewhere.

• California Retail Chains Closing

California Governor SILENT as 4,200 Restaurants Close in 9 Months - "We Can't Survive"

California is losing restaurants at a record pace — not because of bad food or empty dining rooms, but because staying open has become economically impossible.

California Fast Food Industry COLLAPSES as Wage Law Takes Effect

In June 2024, a McDonald's franchise that operated for thirty years closed permanently in San Francisco, citing economic pressures from California's new minimum wage law. Since April 2024, when the state raised fast food wages from $16 to $20 per hour, three separate economic studies have documented between 10,000 and 23,000 job losses across the sector.

California Governor PANICS as Starbucks Shuts Down 300+ Locations Statewide Sophia Miller

Over 300 Starbucks locations are shutting down across California — and Sacramento is scrambling to control the fallout. ☕🚨In this explosive White House Watc...

California Retail in FREEFALL: Walmart’s Secret Store Exit FINALLY EXPOSED | Sophia Julia

California is witnessing a historic retail exodus. From Walmart's "secret" store exits to the total liquidation of 99 Cents Only, the retail landscape is shifting at an alarming rate. In the last 18 months, thousands of jobs have vanished, and entire neighborhoods are being transformed into retail and food deserts.

California Governor SILENT as Pharmacies Abandon Low Income Communities

Neighborhood pharmacies across California are disappearing — and for many residents, access to lifesaving medication is disappearing with them. In this video, Paul Henderson breaks down why hundreds of pharmacies have closed across the state, how policy decisions in Sacramento made them unsustainable, and why seniors and low-income communities are paying the highest price.

California’s Drugs Economy Is COLLAPSING After Walgreens SHUTDOWN 1200 Stores!

Same issue with Rite-Aid going bankrupt ... Previously Rite-Aid purchased Thrifty Drug Store Company. Now all stores have closed, or sold off to other retail chains

Governor Of California IN SHOCK As 7 Eleven SHUTS DOWN All Stores In State!

What’s REALLY happening with 7-Eleven in California? Why are millions of Californians suddenly finding their local convenience store closed? Governor shaken to the core as iconic 7-Eleven locations go dark across the Golden State!

In-N-Out’s Owner Said ‘I’M DONE.’ Here’s What It Costs You!!

In-N-Out just lost its owner to Tennessee. After 77 years, 4 generations, and more tragedy than any family should endure — Lynsi Snyder said enough. She’s moving her family and building a $125 million headquarters in Franklin, Tennessee.

Governor Of California LOSES IT as Gas Station Shutdowns Hit Point of No Return | Alex Lawson

California has hit the "Point of No Return" for local fuel access. Alex Lawson explores the chaos as 473 independent gas stations are forced to lock their pumps following the Jan. 1, 2026, enforcement of the double-walled storage tank mandate. With upgrade costs exceeding $2 million per site and the state's RUST loan program stalled, small business owners are walking away. We report on the emergence of "fuel deserts" and the $5,000-per-day fines that are permanently dismantling the state's retail fuel infrastructure.

Governor Of California PANICS After Love’s Fuel Locations SHUT DOWN | Alex Lawson

Alex Lawson analyzes the panic following the closure of key Love’s Travel Stops. With these critical transit hubs disappearing, interstate commerce is grinding to a halt. We examine why Love’s is de-prioritizing the Golden State in favor of more business-friendly environments in the Southwest.

California Chain Restaurants Are Quietly Retreating | Denny's Exit EXPOSED

Denny’s was born in California — but now it’s quietly pulling back. After 54 years, Denny’s shut down its Oakland Hegenberger Road location, citing employee and guest safety concerns in a corridor hit by repeated incidents.

Governor Of California PANICS After 47,000 Contractors Are FORCED To LEAVE California!

When California's Assembly Bill 2273 introduced the Environmental Construction Standards requiring impossible biodiversity protection compliance, major developers like Lennar Corporation began warning contractors to avoid California projects entirely, triggering an industry-wide exodus that has eliminated 47,000 independent contractors from the state's construction sector.

California Builders Expose What's Slowing Construction

In California, homes can be fully built, inspected, and approved for occupancy, yet still sit unused for months while waiting on basic utility connections. These delays come at the very end of the process, turning finished homes into stalled projects with real financial consequences. In this episode, we speak with Gary Mkrtichyan, Founder of Opus Builders, and Alexis Rivas, Co-founder and CEO of Cover, about why utility delays have become a deciding factor for builders and how that uncertainty is changing what gets built in California.

Immigration As A Network Infiltration Vector

Foreign Combatants, Transnational Gangs, and Hybrid Criminal Systems in California

Migration volume exceeds screening capacity, creating exploitable system blind spots

Sustained high inflows overwhelm identity verification, background checks, housing placement, and case management systems. When throughput becomes the priority, adversarial and criminal actors gain opportunities to pass through the same administrative channels as legitimate humanitarian cases. Over time, these blind spots normalize, reducing the system’s ability to detect repeat or coordinated abuse.

Identity dilution through document fraud, reused addresses, and ghost employment

At scale, weak verification enables the reuse of addresses, fabricated employers, and layered identities that reduce traceability. This creates administrative ambiguity where repeat offenders, facilitators, and logistics personnel remain difficult to distinguish from compliant residents. Once embedded, identity dilution complicates investigations, prosecutions, and removal actions.

Safe-house density and short-term housing enable trafficking and rapid mobility

Overcrowded rentals, informal subletting, and short-term housing provide flexible infrastructure for concealment and movement. These environments support trafficking operations, temporary staging, and fast relocation when enforcement pressure increases. High housing costs and limited oversight further incentivize this model.

Cartel logistics dominate drug distribution, human smuggling, and cash conversion

California’s population density and transportation access make it a prime logistics and retail market. Operations emphasize efficiency, compartmentalization, and laundering rather than visible territorial control, allowing networks to scale quietly. This logistics-first approach reduces exposure while maximizing revenue flow.

Hybrid gangs blend retail theft, intimidation, and cartel-style operations

Traditional street gangs and newer mobile crews increasingly operate as service layers within larger logistics networks. Their activities combine organized retail theft, enforcement, and trafficking support across multiple jurisdictions. Mobility and adaptability replace neighborhood-based control as the primary advantage.

Extremist and foreign-state facilitation operates through low-visibility support nodes

Rather than overt violence, risk often appears as fundraising, recruitment assistance, document facilitation, surveillance, or influence activity. These functions remain embedded in civilian systems to avoid detection and attribution. The cumulative effect is strategic rather than immediately visible, shaping behavior and access over time.

Ports, logistics corridors, and retail zones link import flows to laundering networks

Ports of entry, warehouses, highways, and suburban retail corridors connect physical goods movement to financial conversion. Illicit activity blends into legitimate commerce through volume, speed, and regulatory fragmentation. Disruption becomes difficult when criminal flows mirror lawful supply chains.

Institutional saturation and fragmented enforcement expand network operating freedom

Court backlogs, jurisdictional conflicts, and uneven enforcement reduce deterrence and increase repeat-offender cycling. As accountability diffuses, organized networks gain predictability and freedom of movement. Over time, this dynamic shifts advantage away from institutions and toward adaptive criminal systems.

Why Immigrants Are Leaving California in Record Numbers Before 2026

California’s golden dream is turning into a nightmare for millions. Across the state, unemployment is devastating lives and pushing families to the brink. In this powerful exposé, we reveal the 10 California cities hit hardest by unemployment — and the shocking reasons behind the collapse of local job markets.

800,000 Illegals 'SHIPPED BACK' to Mexico... as California SHUTS DOWN

Activists in California claim the state is struggling now that ICE is deporting federal fugitives, many of whom worked jobs in local businesses that now arent sure how they'll move forward or stay open. However critics say businesses could easily avoid ICE and any business disruptions, if they'd obey America's laws in the first place.

California Court System DISQUALIFIES 450,000 From Jury Pool . . .

The California court system had to disqualify more than 450,000 people from jury duty because they didn’t qualify. “They didn’t qualify because THEY…

Mass deportations could have $275 billion economic impact on CA, new report shows

A new report highlights the economic impact that mass deportations could have on California, and it's in the billions of dollars.

Immigration enforcement takes toll on many SoCal businesses

Across Southern California, businesses have been hurt financially by mass immigration operations, with restaurants hit the hardest as many immigrants work in that industry. Mekahlo Medina reports for NBC4 News at 6 p.m. on Friday, Aug. 21, 2025.

Immigration operations continue in LA County

Immigration enforcement operations are being reported in more Southern California neighborhoods. Lauren Coronado reports for the NBC4 News at 6 a.m. on Jan. 15, 2026.

San Francisco immigration court building to close, what it means

KTVU delivers the best in-depth reports, interviews and breaking news coverage in the San Francisco Bay Area and California.

NEW: Blue State Issued 62,000 CDLs to Illegal Immigrants, Federal Audit Finds

Senior national correspondent William La Jeunesse reports on a fatal car accident in Southern California involving an illegal immigrant truck driver who police say was under the influence of drugs at the time of the incident. Acting ICE Director Todd Lyons reacts

President Trump fires 15 California immigration judges | KTVU

A total of 15 Bay Area immigration judges have been fired since President Trump took office. Judges say the firings will create massive backlogs, while the DOJ says that judges who have "systemic bias" will be terminated.

Central Valley produce goes unharvested as immigration arrests keep workers away

Immigration raids across the country are scaring workers from this year's harvest in California's Central Valley. Scott Rates reports on how the situation could lead to higher prices.

Federal immigration agents swarm LA's Fashion District, spark fear

Video shows unmarked vehicles pulling up to L.A.’s busy Fashion District where agents - some of them armed - stood in the street as an immigration enforcement operation unfolded. Full story:

California city with high Latino population brought to standstill by ICE raids

"CBS Evening News" delivers the day's most important stories, delivering context and depth to bring greater understanding to your world. Check local listings for "CBS Evening News" broadcast times.

Cartel, Criminal, and Foreign-State Network Penetration

The Sinaloa Cartel is widely assessed as the largest and most entrenched cartel operating in California. It maintains the longest-standing distribution footprint across both Southern and Northern California and is the primary controller of fentanyl, methamphetamine, cocaine, and heroin flows into the state. Its decentralized operating model relies on partnerships with local gangs for retail distribution, allowing the cartel to move large volumes while keeping its leadership and logistics insulated from direct exposure.

While other groups are present, including the Jalisco New Generation Cartel (CJNG), they have not displaced Sinaloa’s overall dominance. CJNG has expanded aggressively and represents the fastest-growing challenger in select regions, but Sinaloa’s established infrastructure, laundering capacity, and preference for lower-profile violence give it a structural advantage. In California, Sinaloa effectively sets the baseline for scale and continuity, with most competing operations functioning within or adjacent to its distribution ecosystem rather than above it.

Major Mexican Cartels (Brief Overview)

Sinaloa Cartel

One of the oldest and most sophisticated cartels, known for decentralized leadership, global trafficking routes, and deep logistics capabilities. Historically dominant in fentanyl, meth, cocaine, and international distribution networks.

Jalisco New Generation Cartel (CJNG)

Highly violent and expansionist, with rapid territorial growth and paramilitary-style operations. Known for aggressive tactics, diversified criminal activity, and direct confrontation with rivals and authorities.

Gulf Cartel

One of Mexico’s oldest cartels, now fragmented but still active in trafficking and human smuggling along the eastern border. Formerly closely linked with Los Zetas.

Los Zetas

Originally formed by ex-military personnel, infamous for extreme violence and diversification into extortion, kidnapping, and oil theft. Weakened and splintered, but remnants remain active.

Beltrán-Leyva Organization

Once a powerful splinter from Sinaloa, involved in cocaine trafficking and corruption networks. Significantly diminished but not fully dismantled.

La Familia Michoacana

Originated with ideological and quasi-religious messaging. Active in drug trafficking, extortion, and local control, particularly in central Mexico.

Knights Templar Cartel

A successor to La Familia Michoacana, combining criminal activity with pseudo-ideological narratives. Weakened but persists through regional influence and alliances.

Tijuana Cartel (Arellano Félix Organization)

Historically dominant in northwest Mexico; now fragmented but still active in trafficking corridors near the U.S. border.

Juárez Cartel

Once powerful along the El Paso–Ciudad Juárez corridor; now largely reduced but maintains influence through local gangs and trafficking partnerships.

Santa Rosa de Lima Cartel

Known primarily for fuel theft (“huachicol”) rather than international drug trafficking. Regionally focused with high levels of violence.

Nueva Plaza Cartel

A smaller splinter group operating mainly in Jalisco, often in conflict with CJNG.

System Saturation and Screening Blind Spots

Sustained migration volume places continuous strain on screening, vetting, and case-management systems. As throughput becomes the priority, the depth and consistency of verification decline. This creates blind spots that can be exploited by organized criminal and foreign-linked networks seeking long-term access rather than immediate confrontation.

Identity Dilution and Documentation Abuse

At scale, weak identity controls enable document fraud, reused addresses, and fabricated employment records. These practices reduce traceability and complicate enforcement, investigations, and removals. Over time, identity dilution becomes systemic, not episodic, limiting institutional visibility into networked activity.

Safe-House Density and Embedded Housing Networks

Overcrowded rentals, informal subletting, and short-term housing provide flexible infrastructure for concealment and movement. These environments allow networks to stage operations, rotate personnel, and relocate quickly when attention increases. High housing costs and limited oversight further incentivize this model.

Cartel Logistics, Trafficking, and Cash Conversion

Cartel operations prioritize logistics efficiency, compartmentalization, and revenue flow over overt territorial control. Drug distribution, human smuggling, and associated crimes are structured to minimize exposure while maximizing scalability. Cash conversion and laundering are integral components of these operations.

Hybrid Gangs and Mobile Criminal Crews

Traditional gangs and newer mobile crews increasingly function as adaptable service layers within larger criminal networks. Their activities combine organized retail theft, intimidation, and trafficking support across multiple jurisdictions. Mobility and coordination replace localized control as the primary operating advantage.

Extremist and Foreign-State Facilitation Nodes

Rather than direct violence, risk often manifests through facilitation activities such as fundraising, recruitment assistance, documentation support, surveillance, or influence efforts. These nodes remain low-visibility and embedded within civilian systems. Their impact is cumulative and strategic rather than immediately observable.

Ports, Transportation Corridors, and Retail Crime Ecosystems

Ports of entry, warehouses, highways, and suburban retail zones form interconnected corridors for goods movement and cash conversion. Illicit activity blends into legitimate commerce through volume and speed. This overlap makes detection and disruption more complex.

Money Laundering Through Cash-Front Businesses

Cash-heavy storefronts and shell companies are used to legitimize illicit revenue streams. These fronts often display minimal genuine commercial activity while maintaining consistent financial throughput. Once established, they provide durable financial cover for broader network operations.

Institutional Overload and Enforcement Fragmentation

Court backlogs, jurisdictional conflicts, and uneven enforcement reduce deterrence and increase repeat-offender cycling. Fragmentation across agencies limits coordinated response and pattern recognition. As predictability declines for institutions, operating freedom increases for organized networks.

Conditional Escalation and Latent Network Risk

The primary concern is not imminent mass violence, but the presence of latent networks positioned for optional escalation. Capability exists independently of intent and may remain dormant until triggered by geopolitical, economic, or domestic instability. This conditional risk profile complicates traditional threat assessment.

Inside Cartel Infiltration in California Growing Areas | William Honsal

Across parts of Northern California, law enforcement officials say investigations are revealing the ways criminal operations have evolved in response to enforcement and regulation. In this episode, Humboldt County Sheriff William Honsal describes how these enterprises function and why their methods are having economic and social effects that extend beyond the areas where they operate.

ICE Arrested 1000+ Mexican Cartel Group in Massive Crackdown & Destroyed Border Routes

Before sunrise along the U.S.–Mexico border, federal command centers launched one of the largest coordinated enforcement campaigns ever directed at cartel logistics operating inside and around the United States. According to federal officials, intelligence revealed cartel-linked smuggling networks had escalated to placing cash bounties on U.S. law enforcement personnel, including ICE agents and Border Patrol supervisors. That threat triggered a decisive response.

Inside California Border Operations: Raids, Cartel Activity, and Federal Response | Backscroll

This Backscroll episode includes an exclusive interview with the Border Patrol chief on escalating California raids and an investigation into a suspected cartel-linked home burglary raising new security concerns.

The Cartel War Inside California Wildlands

Lt. John Nores(ret), a native of California, grew up in a small town in rural Santa Clara County. As the oldest of four children, he and his siblings—whom their mother affectionately called "the wolf pack"—developed a deep love for nature and the outdoors from a young age. Initially, John entered college with aspirations of becoming a civil engineer.

INSIDE the Cartel’s Control of Northern California | Mendocino County’s Role in U.S. Trafficking

On today’s episode, Vince sits down with Johnny Mitchell, comedian, former trafficker, and host of The Connect with Johnny Mitchell, to go inside the world of drug trafficking and organized crime. Johnny shares his firsthand experiences running operations and embedding with cartel members and sicarios, offering rare insight into how these organizations operate daily.

Cartels In The Wasteland: An Inside Look At California's Massive Illegal Grow Operations

In this video, I explore the raided ruins of illicit grow sites once operated by drug cartels, foreign-backed criminal networks, and local gangs. These locations reveal how illegal grow operations are set up, how they exploit land and resources, and how law enforcement eventually tracks them down and shuts them off.

"She Was Executed" - Inside the Deadly World of Criminal Cartels | Official Preview

Katarina Szulc is an investigative journalist and the host of Borderland: Dispatches, a show delivering raw, on-the-ground reporting from the front lines of Mexico’s cartel war. With a sharp lens on organized crime, corruption, and cross-border conflict, she brings listeners real-time snapshots of a rapidly evolving crisis that’s reshaping both Mexico and the United States.

Who Really Runs Mexico? The Truth About Cartels! | Forgotten History

For over 30 years, Mexican drug cartels have assassinated politicians, infiltrated law enforcement, and taken over entire cities. From El Chapo’s Sinaloa empire to the rise of CJNG and allegations against Mexico’s first female president—this episode exposes the brutal truth about who really controls Mexico. How did we get here—and why won’t the U.S. step in?

Exposing a Massive CCP Infiltration Plot at the U.S. Border in California | Official Trailer

On today’s episode, Andy talks with Cory Gautereaux—Army veteran and founder of The G.O.A.T. Initiative—about what he’s uncovered along remote sections of the southern border. From finding discarded passports from countries like China and Venezuela, to accessing a smuggler’s Chinese phone, to identifying stretches of the border that remain completely unguarded, Cory shares raw details from the ground.

CCP Infiltration EXPOSED: Chinese Intelligence Operations Run on U.S. Soil in Plain Sight

On today’s episode, Katarina is joined by a former intelligence analyst to break down how the Chinese Communist Party uses community associations, tech companies, student groups, and overseas police stations to extend its influence in Western countries. Together, they explore the role of fentanyl supply chains, financial entanglements with U.S. elites, and how historical lessons from the Opium Wars shape modern CCP strategy. This episode explores the subtle but far-reaching tactics of political, economic, and societal infiltration.

INSIDE the Cartel’s Control of Northern California | Mendocino County’s Role in U.S. Trafficking

On today’s episode, Vince sits down with Johnny Mitchell, comedian, former trafficker, and host of The Connect with Johnny Mitchell, to go inside the world of drug trafficking and organized crime. Johnny shares his firsthand experiences running operations and embedding with cartel members and sicarios, offering rare insight into how these organizations operate daily.

"My Jaw Was on the Floor!" Inside the Cartel’s Takeover of Southern California

Vince sits down with NewsNation’s Jorge Ventura to explore the shocking truth behind cartel operations in rural California. From illegal marijuana farms and water theft to trafficking teenagers as workers, this eye-opening investigation exposes how cartels are infiltrating American soil.

Former Prison Guard on Why California's Most Violent Prisons Are Collapsing - Cartels & Cover-Ups

On today’s episode, Vince sits down with former California corrections lieutenant Hector Bravo to break down what he says is a growing crisis inside the California Department of Corrections and Rehabilitation (CDCR).

The LA Protests: What's Really Happening

On this special Borderland: Narcosis interview, Vince sits down with investigative journalist Jorge Ventura to break down the chaos unfolding in Los Angeles. What began as peaceful protests has spiraled into violent clashes, property destruction, and citywide unrest. Jorge offers a frontline perspective on how these protests escalated, what the mainstream media is leaving out, and the deeper social and political tensions fueling the turmoil.

"This Is WHERE Sinaloa REALLY Operates" - INSIDE America's Most Cartel-Controlled Cities

Vince sits down with former Sinaloa trafficker Pierre Rausini to discuss The Sinaloa Cartel's U.S. operations are smaller than most think. Major trafficking transactions happen in key hubs like Los Angeles, Chicago, New York, and Atlanta—but most Mexican traffickers in the U.S. aren’t actual cartel members

Financial Systems

Banking Exposure & Regional Bank Risk

California’s banking system is increasingly exposed to concentrated risks tied to commercial real estate, multifamily housing, venture-backed firms, and municipal debt. Regional and community banks—many of which are heavily concentrated in California markets—face rising loan delinquencies, declining collateral values, and refinancing failures. Unlike diversified national banks, these institutions lack balance-sheet flexibility, making them vulnerable to cascading defaults as office, retail, and industrial properties reprice downward across California.

Municipal Debt, Pension Liabilities & Insolvency

Cities, counties, and special districts across California are carrying unsustainable debt loads layered on top of massive unfunded pension and healthcare obligations. These liabilities were structured during periods of population growth, rising tax revenues, and optimistic return assumptions that no longer hold. As revenues stagnate or decline, municipalities face impossible trade-offs: cutting services, raising taxes, or deferring obligations. Insolvency risk is increasing quietly, often masked by accounting practices, one-time federal funds, or short-term borrowing.

Bond Market Confidence Erosion

California’s municipal bond market is experiencing growing skepticism from investors as credit risks become harder to ignore. Rising interest rates, declining tax bases, and exposure to real estate and pension stress are pushing borrowing costs higher. Bond buyers now demand greater risk premiums, while some issuers face limited or no market access at reasonable rates. This erosion of confidence constrains infrastructure spending, emergency response capacity, and long-term capital planning statewide.

State & Local Tax Revenue Collapse

California’s tax system is uniquely vulnerable due to its reliance on high-income earners, capital gains, and corporate profits. As wealthy residents relocate, stock-based compensation declines, and businesses exit the state, revenue volatility increases sharply. Sales taxes weaken as consumption slows, while property tax growth stalls amid falling valuations and transaction volume. The result is a structural revenue shortfall that cannot be solved through marginal tax increases without accelerating further population and capital flight.

Why This Section Matters

Financial systems are the transmission layer of collapse. When banks retrench, bond markets tighten, and public revenues fall, every other sector—education, healthcare, infrastructure, public safety—loses support simultaneously. Financial stress does not announce itself loudly at first; it appears as delayed payments, deferred maintenance, and “temporary” fixes that quietly compound into systemic failure.

California’s Pension Crisis Is Exploding | Millions Could Lose Everything!