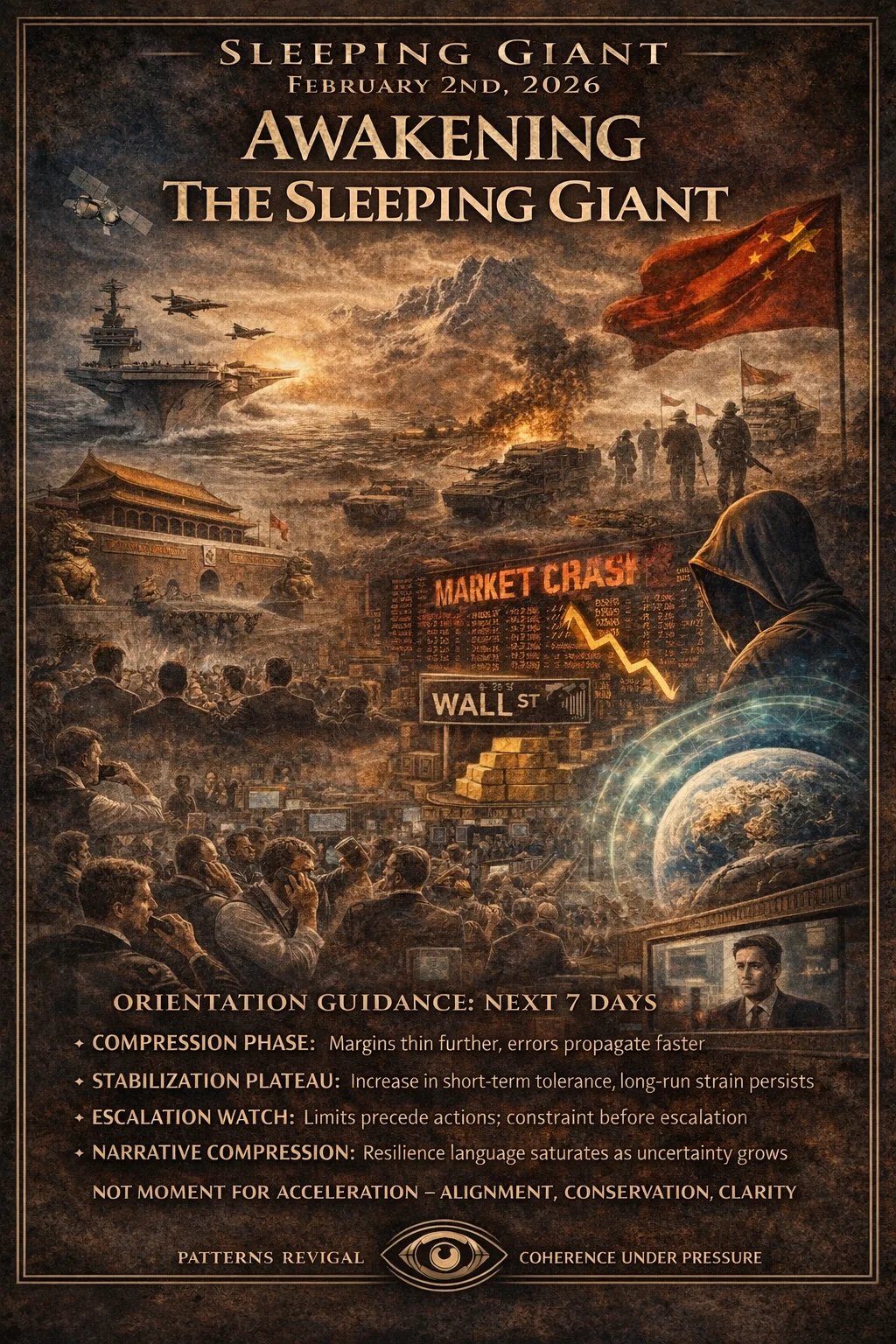

Published Date: February 2nd, 2026

WEEKLY REPORT

TRUTH///AWAKENING///DISCLOSURE

AWAKENING THE SLEEPING GIANT SERIES

Constraint Synchronization Reveals Hidden Structure Across Global Systems

“When constraints align across systems, disorder collapses into pattern. Those who stay oriented don’t see chaos — they see sequence.”

KEY SIGNALS

Capital pauses • Trade rigidifies • Authority disperses • Demand contracts • Force aligns • Governance strains • Planetary stress

ORIENTATION BRIEF — WEEK OF FEBRUARY 2nd, 2026

Forward Look: Next 7 Days | Stories, Signals & System Posture

The coming week favors positioning over movement. Systems are not preparing to break; they are preparing to endure. Across geopolitics, trade, finance, governance, technology, and environmental domains, the dominant signal is controlled strain rather than resolution. Constraint—not surprise—defines the near-term environment. Stability is being maintained through effort and management, not restored through structural correction, which means activity continues even as freedom of action narrows.

This is a high-friction holding pattern. Institutions, markets, and households are expending energy to preserve equilibrium rather than advance. The operational reward structure shifts accordingly: discipline over speed, patience over force, clarity over reaction. Momentum exists, but it is carefully bounded.

Compression continues to deepen without release. Margins thin further across institutional capacity, supply chains, household resilience, and biological tolerance. Sensitivity moves away from headline shocks and toward secondary and tertiary effects—small disruptions that cascade faster than expected. The forward risk is not sudden volatility but gradual overextension. Systems are becoming less tolerant of inefficiency, and minor errors now propagate with disproportionate impact. Orientation in this phase favors simplification, energy conservation, and deliberate pacing.

The stabilization plateau remains actively defended. Markets, governments, and trade flows continue to function through intervention, rerouting, liquidity management, and disciplined messaging. However, the cost of maintenance continues to rise. Stability increasingly depends on sustained input rather than organic recovery, turning equilibrium into a conditional state. Plateaus rarely fail suddenly; they erode quietly as effort begins to exceed capacity. Subtle degradation—not abrupt collapse—is the signal to watch.

Several domains sit just below action thresholds as the week unfolds. Military posture and signaling remain elevated but contained. Financial systems show sensitivity to confidence and liquidity preference shifts rather than structural weakness. Information boundaries continue to narrow, and environmental and infrastructure stress persists in the background. No specific triggers are expected in the immediate window, but optionality continues to compress. Historically, limits appear before actions—through constraints on access, movement, liquidity, or expression—well ahead of overt escalation.

Narrative compression will intensify further. Language emphasizing resilience, normalization, and continuity is likely to increase, while uncomfortable or destabilizing variables recede from public view. As uncertainty rises, messaging simplifies and synchronizes. Transparency gives way to coherence management. In this environment, omissions, timing, and repetition carry more signal than volume. What is not said will remain more instructive than what is amplified.

Orientation for the week ahead is clear. This is not a moment for acceleration; it is a moment for alignment, conservation, and clarity. Staying locally grounded, maintaining optionality, and avoiding unnecessary exposure—financial, emotional, or informational—reduces friction. The signal ahead is not collapse, but constraint revealing structure. Those who remain calm, coherent, and pattern-aware will move through the coming phase with less resistance as conditions continue to tighten.

UPDATED SIGNAL BRIEF | Week Ending February 2, 2026

Geopolitical PostureOver the past seven days, geopolitical signaling intensified without tipping into open confrontation. The aftereffects of Davos continued to shape elite discourse, with NATO posture, U.S.–EU friction, and power realignment remaining dominant themes. U.S. strategic messaging—particularly around tariffs, Greenland leverage, and alliance expectations—reinforced a posture of calculated unpredictability. The signal is not escalation, but presence: force posture and diplomacy remain elevated while ambiguity is increasingly used as leverage. Power signaling now extends beyond troop movements into economic and policy instruments, blurring the line between strategy and theater.

Global Trade ChokepointsTrade dynamics this week further confirmed that commerce is no longer a neutral domain. Tariff threats and policy-linked trade pressure continued to ripple through markets, while parallel efforts—such as India–EU strategic alignment—highlighted how regional blocs are adapting to politicized trade risk. The shift is structural: trade stress is expanding beyond physical chokepoints into regulatory and policy space. Adaptation frameworks are emerging alongside coercive trade tactics, creating a dual-track system of negotiated resilience versus punitive leverage.

Government & Institutional DragInstitutional behavior over the past week emphasized continuity over action. Governance discussions remained focused on resilience narratives and long-term norms rather than rapid corrective measures. This reflects a deeper pattern of institutional drag: momentum exists in dialogue, not in execution. The signal is not paralysis, but delay—systems acknowledge strain while deferring decisive adjustment, reinforcing a widening gap between recognition and response.

Household StressWhile no single headline event defined household conditions, economic pressure continued to accumulate beneath the surface. Market volatility, tariff uncertainty, and mixed policy signals fed into broader risk sentiment, subtly shaping household decision-making. The pattern remains one of incremental behavioral shift rather than shock—greater caution, delayed spending, and latent stress tied to macro uncertainty rather than immediate crisis.

Financial SystemMarkets over the last week oscillated between confidence and caution. Sharp reactions to tariff rhetoric underscored how sensitive liquidity has become to policy signaling rather than fundamentals alone. Capital remains available, but participation is increasingly selective, with periodic rotations into perceived safe havens. The signal is repricing, not retreat: risk appetite cycles continue, reflecting belief in system continuity tempered by heightened awareness of policy-driven volatility.

AI, Biotech & Bio-SovereigntyAI and advanced technology remained structurally important but thematically secondary amid geopolitical dominance in public discourse. Corporate behavior tells a clearer story than policy debates: CEOs continue integrating AI as a resilience and efficiency strategy despite regulatory ambiguity. Innovation is leading while governance lags, reinforcing a familiar pattern in which capability deployment outpaces institutional oversight.

Solar, Geomagnetic & Human SensitivityNo major new empirical developments emerged this week, but prior environmental and biological stress indicators remain part of the background signal field. These inputs continue to function as slow-accretion variables—subtle, cumulative, and influential over time rather than event-driven. Their relevance lies in persistence, not immediacy.

Information & Narrative CompressionNarrative management tightened further over the past seven days. Institutional messaging emphasized stability, continuity, and resilience, while alternative interpretations were increasingly sidelined. This reflects a broader compression pattern: as systemic pressure rises, authoritative narratives narrow. The signal is not consensus, but control—reducing interpretive bandwidth to maintain confidence.

Pattern ConvergenceAcross geopolitics, trade, finance, institutions, and information space, adaptive behaviors aligned around a common response to constraint. Markets repriced risk, trade agendas shifted, geopolitical posture projected firmness without action, and institutions reinforced continuity narratives. These are not isolated developments but expressions of a single structural pattern: convergence through adaptation rather than resolution.

Weekly SynopsisSystems remain strained but intact. No kinetic escalation occurred, and no single domain broke from the broader trajectory. Stress signals expanded rather than contracted, and adaptive behaviors continued to dominate across sectors. Geopolitical risk now explicitly incorporates economic-policy levers, markets show heightened sensitivity to signal volatility, and institutional narratives increasingly outpace decisive action. There is no resolution and no collapse—only continuation. The prevailing direction remains clear: adaptation over restoration, positioning over commitment, and coherence management over transformation.

“When the illusion of order dissolves, what remains is resonance. In the light of truth, even collapse becomes creation.”

A Call to Patriots

Let this moment be remembered as a time of clarity, not chaos—when citizens chose discernment over outrage and responsibility over fear. The republic is not reclaimed through force or noise, but through truth, accountability, and lawful restoration.

Patriots are defined by their ability to remain coherent under pressure, to reject deception, and to stand firm as systems are rebuilt. This is not a call to conflict, but to orientation, integrity, and justice allowed to function.

History will remember who stayed steady when it mattered most.

The Great Civilization Near Death Event | NDE

“Be Strong Enough to Stand Alone / Be Yourself Enough to Stand Apart / And When the Time Comes, Be Wise Enough to Stand Together”

The Great Reset of Everything

We have entered a window of time where everything we have learned, experienced and known to be true is about to dramatically change. We are Awakening to a great truth, “That Everything We Were Taught Is A Lie”. The lives we once knew, lived and experienced prior to January 2020 are now gone forever. We are witnessing the total collapse of not just a few, but all of our statured institutions; The US Government Senate/Congress; through the NSA, DOD, CIA, DIA, ATF, ONI, US Army, US Marine Corp, FEMA and DHS have spent in excess of 12 trillion dollars building the massive, covert infrastructure for the coming One World Government and New World Religion over the past 40 years. Along with other industries; Wall Street Markets & Finance, Banking Industries, Big Tech, Big Insurance, Pharma, Oil, Education, Hollywood Industries, US Military, Medical AMA, Military and Energy Industrial Complexes, all are embroiled in corruption scams and human trafficking.

Given the monolithic corruption and evil encrusted within all these institutions, We are now Witnessing in Real Time a Global Everything Collapse. What has been described and depicted as The Storm! and “The Great Civilization Near Death Experience”. The fallout of which could last anywhere from 2 to 5 years based on geographic locations.

We will then have a choice and chance for “A New Beginning to Reset Everything as We Rebuild America”.

The following report is a compilation of different sources. We found a number of overlapping and crossover warnings presented by each of our sources. We formatted this Weekly Report based on a timeline tied to dates and information posted entirely in May 2023. We believe these sources align with each other to create a very rare picture of what is happening behind the scenes. We encourage each of you to use your own discernment and rational, critical, logical thinking in reviewing this information. Preparation going forward is 80% mental and 20% physical, so we hope this will assist you in your education and in being mentally prepared for the coming Storm.

Updates: This Report Will Be Updated on a Weekly Basis. We designed this format as a living document so we can update you directly on all breaking news and events. Please keep this link close by, so you can easily return to this Weekly Report for all the latest alternative uncensored news reports.

“We The People”: If we the people, as a nation, do not work together to restore our founding father's visions for our Constitutional Republic, our children could be lost and our nation will be destroyed. We all have a part to play in this peaceful, faithful, informed, prayer-filled participation and with forgiveness in our hearts for the corruption of this nation that we have been a party to, either knowingly or unknowingly.

A Message From the Hopi Elders

Written By Maira Horta LMFT

You have been telling the people that this is the Eleventh Hour.

Now you must go back and tell the people that this is The Hour.

Here are the things that must be considered:

Where are you living? What are you doing? What are your relationships? Are you in right relation? Where is your water? Know our garden. It is time to speak your Truth. Create your community. Be good to each other. And do not look outside yourself for the leader.

This could be a good time!

There is a river flowing now very fast. It is so great and swift that there are those who will be afraid. They will try to hold on to the shore. They will feel like they are being torn apart, and they will suffer greatly.

Know the river has its destination. The elders say we must let go of the shore, push off toward the middle of the river, keep our eyes open, and our heads above the water.

See who is there with you and celebrate.

At this time in history, we are to take nothing personally, least of all ourselves! For the moment we do, our spiritual growth and journey comes to a halt.

The time of the lonely wolf is over. Gather yourselves!

Banish the word struggle from your attitude and vocabulary.

All that we do now must be done in a sacred manner and in celebration.

We are the ones we have been waiting for.

-The Elders, Oraibi, Arizona, Hopi Nation

*THE REMAINING CONTENT ON THIS REPORT IS FOR PAID SUBSCRIBERS ONLY, PLEASE SUBSCRIBE OR LOGIN*